Last Update: April 2021

Why spend thousands of euros and hours building your own bank, when you can offer the same services for half the cost and time by partnering with a banking provider?

That’s Banking as a Service: a new way of offering banking services, for half the cost and in half the time it usually takes. It’s also called “white-labeled banking”, and many are describing it as the future of financial services.

In this post, we’ll be explaining what BaaS is, why you should care about it and its main use cases over the next 5 years.

Read straight through, or jump to the section you want to read

- What is Banking as a Service

- Why should you care about BaaS

- How BaaS works

- Successful use cases

- How to Build a Neobank

- Open Banking meets BaaS

- Traditional Banking vs Banking as a Service

- Build your own bank or partner with a banking provider

- Banking as a Service Benefits

- Industry impact of Banking as a Service

What is Banking as a Service?

Banking as a Service is the act of taking bank functionality as a whole, compartmentalizing it, then individually offering each function to non-financial companies.

Like other “as a Service” models, BaaS uses mainly application programming interfaces (APIs) to provide connectivity with its users. Since the providing bank has all of the regulatory permissions to offer banking services, BaaS users can integrate them without having to go through burdensome regulations themselves.

Together, these factors enable non-financial companies to build new products using banking services such as deposits, money transfer, payments, currency exchange, lending, and more.

For example, Carrefour is a well-known consumer retail company in Europe. They offer loyalty points and cards to their best customers. What if they could take this to the next level by offering deposit accounts to their customers? Or even offering credit at the point of sale to their most loyal customers?

By partnering with a BaaS provider, Carrefour can offer its own bank accounts without having to go through the arduous process of becoming a bank. Not only that, but the BaaS provider will also offer them other features, such as automatic payments, identity verification, and even debit cards.

If you’re still confused, don’t worry. We’ll look into the top use cases below.

Why should you care about BaaS?

But first, why should you care about BaaS?

It feels like almost every week, another part of our world gets parsed into an “as a Service” package. This growing trend shouldn’t surprise anyone.

But BaaS is more than just a package service – it’s a business model. It’s a way of managing financial services that is fundamentally redefining the role of financial services in our society.

Look around you: Amazon is attacking financial services from every angle (Amazon Payments, Amazon Go, Amazon Cash), 60% of Shopify’s revenue comes from its financial solutions and retailers like IKEA are now expanding into consumer banking. If the large conglomerates are doing it, it means the industry is shifting.

From our own experience working with hundreds of clients, we are seeing in real-time how financial features are being introduced into thousands of products. And it makes sense: as a software company or merchant, you likely have customers who trust you. By offering them financial services, you can now leverage that relationship even further.

Before, launching banking features cost millions of euros, required building an entire banking team, and demanded months, if not years, of getting regulatory approvals. With BaaS, you can do it with less investment, in a couple of months, and with just an API.

That’s why you should care.

How BaaS works

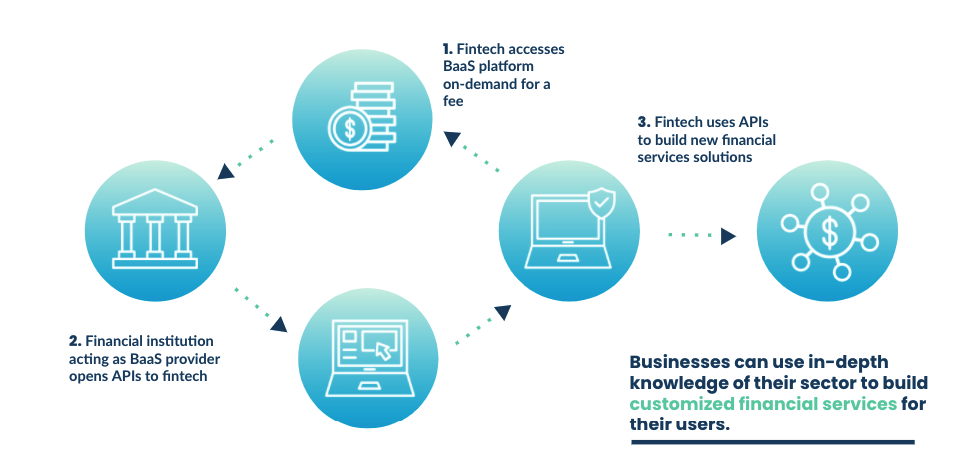

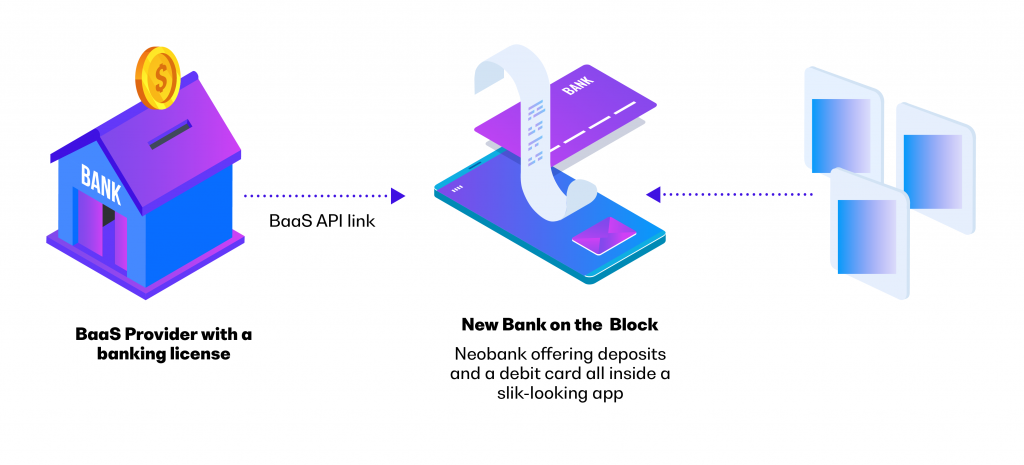

The easiest way to explain this is with a diagram:

With BaaS, any company can essentially become a “bank” through a BaaS provider.

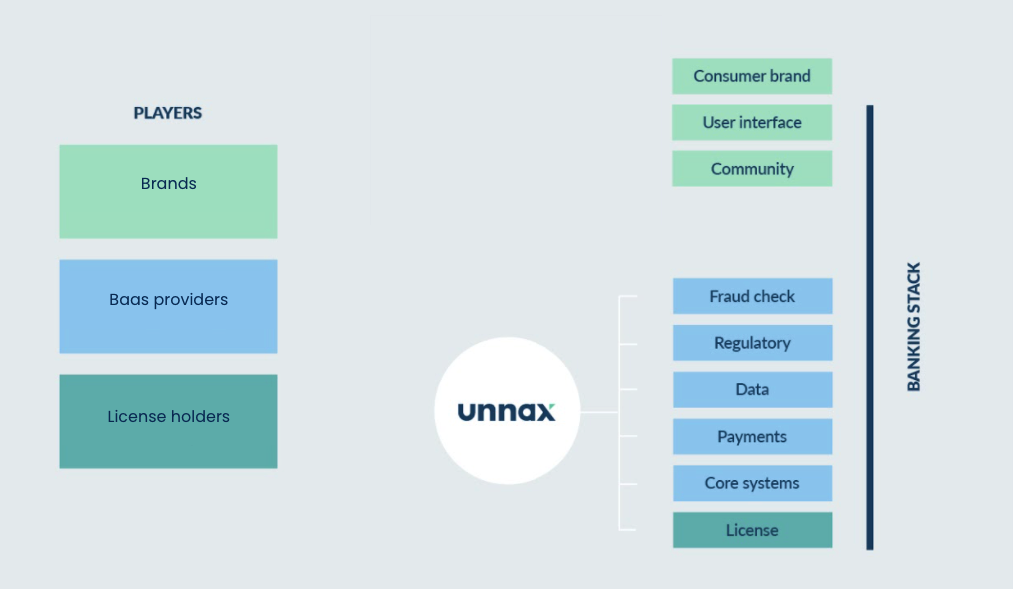

The system works through layers:

- At the bottom, you have the license holder – usually a bank or regulated institution that has the right licenses such as an EMI or AISP/PISP license.

- On top of the licenses, you then have other financial providers that offer other services, such as treasury, KYC, authentication, and compliance. These are provided by third parties or might also be part of the package with the license holder.

- Then at the very top, you have the brand: the merchant and the relationship with their customers.

All this layering happens through APIs, which is similar to a plug-and-play model. This is what makes it very easy to integrate with several third-party providers and opens up the banking stack to plenty of possible solutions.

Learn more: Banking as a Service API for instant payments

Top use cases

Card payment and processing

With new regulations coming up such as 3DS2 and the increase in Visa and Mastercard fees, merchants are looking elsewhere for cheaper payment processing.

BaaS enables non-financial companies to add branded payment services to their product line-up. These services allow firms to offer white-labeled debit cards, which increase brand loyalty and greater insights into their customers’ behaviors.

With BaaS based on an Open Banking framework, merchants can accept direct bank transfers as a payment method. Direct bank transfers are a fraction of the cost, don’t cause chargebacks, and happen in real-time.

You may like: How eCommerce can upgrade payment technologies with Open Banking

Identity verification

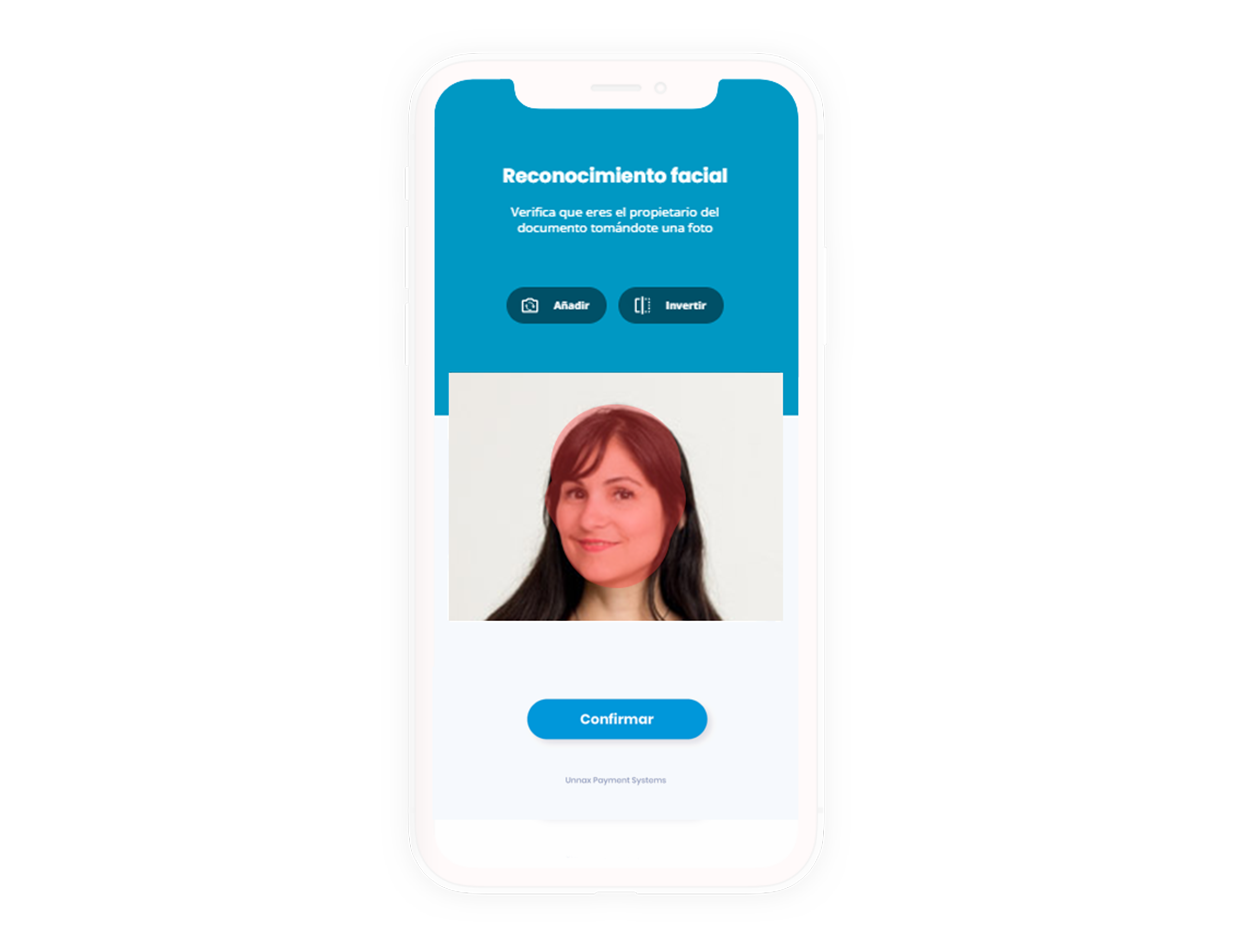

Regulations are tightening to decrease fraud and identity theft, which often means companies need to implement more technologically sophisticated identity verification services.

By partnering with a specialist BaaS provider, companies don’t have to worry about building their own KYC solution and keeping up to date with new regulations. Instead, they can plug into a bank’s KYC API so customers can quickly and affordably verify their identity.

Lending

With eCommerce getting more competitive by the day, the only way to stand out is to build a strong relationship with the customer. Lending offering merchants an opportunity to offer a more comprehensive service to customers as well as open up a new revenue stream.

This works well for retailers that sell big-ticket items such as travel and eCommerce. These firms can provide on-platform financing using a consumer lending BaaS API. The providing bank underwrites and potentially finances the loan, helping the merchant convert big sales.

Plug-and-play neobank

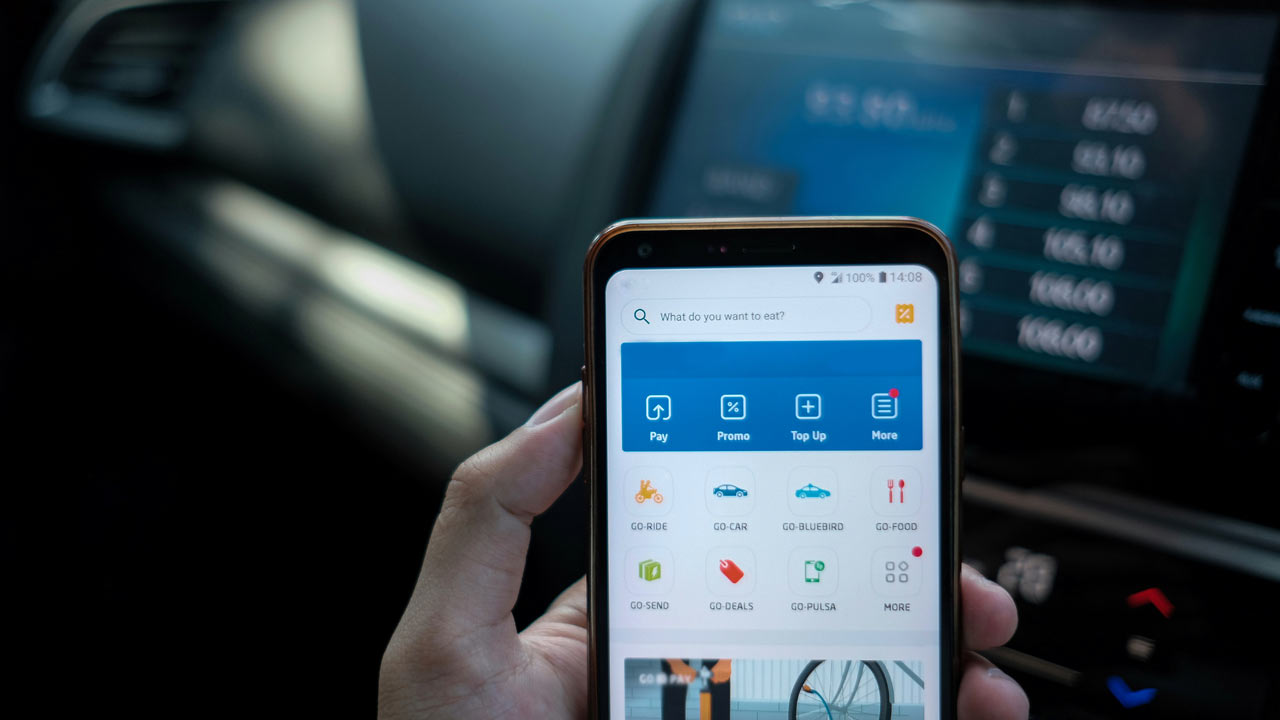

Imagine you could bank with your union? Or your favorite brand? BaaS allows brands, merchants, and almost anyone to set up their own neobank for their customers.

Some startups see BaaS as the perfect medium to re-invent the entire banking experience by creating neobanks. These firms use Banking as a Service to provide everything from a payments card to segregated customer accounts.

Other entrepreneurs focus on a specific banking vertical such as currency exchange deploying BaaS to disrupt notoriously fee-ridden services.

How to Build a Neobank

Neobanks are essentially digital banks. They’re very similar to your traditional high street bank, but they only exist online. Their main advantages usually include a superior user interface, faster customer onboarding, and better funding and loan processes.

These neobanks are heavily reliant on BaaS since their entire banking stack is built by third parties that take care of everything that happens behind the scenes. It’s what allows neobanks to start with very little and focus on what they do best: offering an excellent customer experience.

When a neobank wants to get set up, they usually need to partner with a BaaS provider that holds an EMI license. This will also provide them with account aggregation, regulation, and partnership with a card network. If they want to issue lending, they will need to partner with other providers that have the appropriate licenses.

To make it all work, neobanks are based on APIs. Depending on the services they offer, they may need to get an AISP or PISP license themselves. All this has the goal to put the customer at the center so they receive the best services possible.

You may like: What is an electronic money institution?

Open Banking meets BaaS

In the fast-moving world of Fintech, many words and phrases get tossed around, often a bit too liberally.

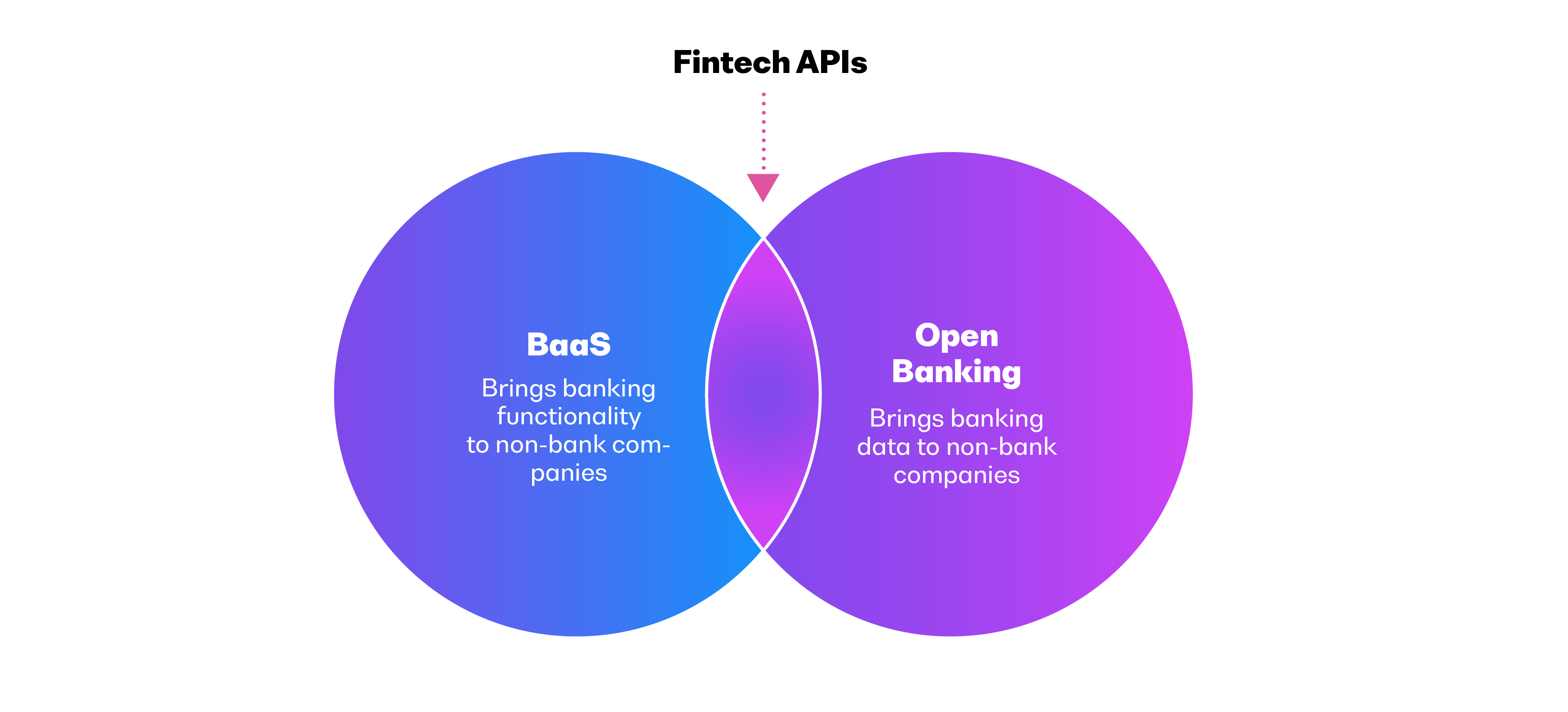

This farrago leads to understandable confusion, especially among similar-sounding terms. Open Banking and Banking-as-a-Service tend to get used interchangeably. However, that’s incorrect.

Open Banking is about the opening of banking data from banks to third parties. Under this system, external companies known as third-party providers connect user bank data to non-banking entities. In turn, these entities use that information to help improve their services. For instance, an eCommerce company can use a customer’s banking data to determine if he is a trustworthy candidate for a loan.

Learn more: What is Open Banking?

BaaS, on the other hand, is about providing banking functionality to non-banks. Instead of looking at user data, the non-bank entity can incorporate certain banking functionalities into their services. In other words, a company using a BaaS service is creating financial data through functionality, not merely accessing it.

Put simply, BaaS is a business model, whereas Open Banking is the framework that makes BaaS possible. BaaS sits under the umbrella of Open Banking, which is then regulated by directives such as PSD2 in Europe.

Traditional Banking vs Banking as a Service

Some companies choose to build their own bank, rather than partner with a bank. This is what M&S in the UK chose to do in the 1980s, or what Varo Money recently did in the US.

If you read up on what happened, you’ll see that it took each of these companies millions of dollars and pounds, and over a year to implement. It’s also no guarantee for success. In fact, in 2021, M&S decided to shut down its financial services branch.

Should you build your own bank or partner with a banking provider?

Let’s compare the two:

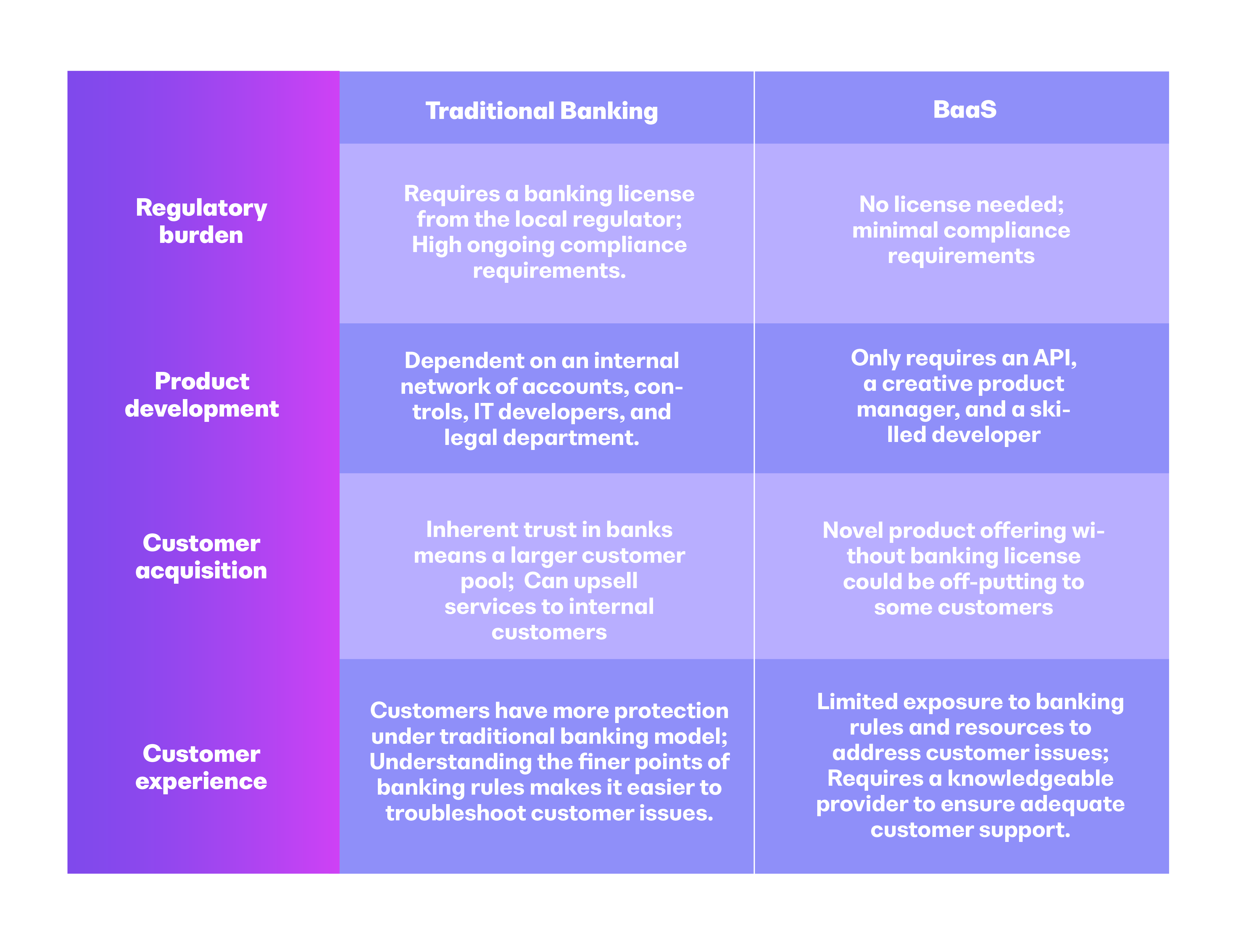

Regulation:

If you’re planning on building your own bank, you’ll need to meet very strict compliance as well as ongoing regulatory requirements. By partnering with a banking provider, someone else takes care of that.

Product development:

In order to maintain your bank, you’ll need an entire team of developers, controls, and a big legal department. With a bank partner, you just need APIs.

Customer acquisition:

Since it’s your bank, it’ll be easier to garner trust with your customers, translating into a larger customer pool and allowing you to enable and upsell them. If you partner with a bank, some customers might not be as keen to sign up and will need to be educated on the banking process.

Customer experience:

Your in-depth understanding of the banking rules will make it easier to troubleshoot customer issues and fix large-scale issues. When you work with a bank partner, your exposure is limited which can make it difficult to address certain customer issues. That’s why you need to make sure you are collaborating with a knowledgeable provider.

At the end of the day, it depends on why you want to offer financial services. If you are a merchant that is just looking to grow your business by offering financial products, partnering with a BaaS provider will probably be enough. If you’re on a mission to redefine banking and finance, then it might be worth building your own bank.

Banking as a Service Benefits

Banking as a Service creates a world of benefits for end-users, non-financial companies, and even banks.

BaaS benefits for the end-users

First and foremost, Banking as a Service is overwhelmingly positive for the end-user. As more companies add digital financial services, consumers get more choices. More choice means more competition.

As a result, fees go down and user experience goes up. Moreover, thanks to the combination of BaaS with machine learning, automated customized experiences bring private banking to the masses.

BaaS benefits for financial companies

Consumers aren’t the only ones who benefit from Banking as a Service. Firms specialized in accounting, corporate finance, and SME lending can leverage BaaS to give businesses more choice and better services.

Learn more: Why Open Banking is making UX the future focus in retail finance

BaaS benefits for non-financial companies

Highly competitive industries like eCommerce and travel have notoriously thin margins. For companies in these sectors to survive, they must both prove their worth and diversify their revenue streams. BaaS satisfies both needs. For example, travel companies can issue prepaid debit cards to their clients to use while out exploring the world.

Understanding customer spending habits is one of the most valuable marketing tools companies can have at their disposal. For firms using Banking as a Service, they become primary sources of customer financial data.

More importantly, providing banking services helps keep users on the platform, regardless of the industry. BaaS represents a potent competitive weapon in cut-throat business across the spectrum.

BaaS benefits for banks

Finally, the banks themselves benefit from BaaS. After all, banks already have banking licenses. By offering services through their system to third parties, they can earn valuable fees and deposits. Additionally, becoming a BaaS provider has in-house upsides as well since it means transforming their legacy tech stack into a modern, cloud-based one.

BaaS’ limitations

Despite the many advantages with BaaS, there are also some inherent drawbacks. First, having limited views and knowledge of banking can make it difficult for firms to address customer issues. In this instance, a company looking to incorporate BaaS should make sure their provider has robust support for any client or tech-related matters.

Second, regardless of their reputation, consumers still tend to trust banks with their money. This relationship creates a formidable conversion hurdle for the BaaS user to overcome. Companies wanting to implement BaaS-driven products should anticipate these minor limitations when planning and developing new services.

Industry impact of Banking as a Service

If you’ve read through our entire piece you’ll hopefully have a better understanding of what Banking as a Service is about and why you should care about it.

By unbundling banking and making it “integratable”, the opportunities for financial services are suddenly limitless. Not only are companies capable of delivering valuable service to customers, but it’s also a model that enables financial transparency and makes banking less of a black hole for customers.

BaaS is also impacting traditional high street banks: its democratization of data means that banks are no longer monopolizing the markets, and are obliged to partner up to remain relevant to their users. Banks will no longer be the sole providers of banking services, which could have a huge impact on the industry in ways that are yet to be explored.

Finally, BaaS helps meet the rising demand for embedded finance. We’re seeing accelerated demand for integrated experiences, more third-party fintech providers, and an increase in the popularity of Open APIs. With embedded finance, we could potentially see a 5x increase in revenue per customer.

While BaaS is redefining the industry, the train has only just left the station. It’s still a relatively new market and there are still many use cases to be explored. This provides merchants with an opportunity to stay ahead of the competition while building stronger customer relationships.

At Unnax, we are one of the few BaaS providers in Spain that help large companies such as Carrefour, Prosegur, and Cofidis offer financial products to their customers. Learn more about what we do at Unnax to see if we can help you too.