Fraud is one of the most expensive issues facing eCommerce businesses, with a report estimating it cost them over $12 billion in 2020.

Although eCommerce companies are no doubt benefiting from the surge in online shopping, the boom has not come without its own stumbling blocks, namely debit and credit card fraud.

With merchants already facing over 206,000 attacks on their store per month, fraud mitigation is a top priority for eCommerce companies. And as we’ll see in this post, one of the most reliable ways to combat fraud is better payment technology such as Open Banking and APIs.

The problem with card payments

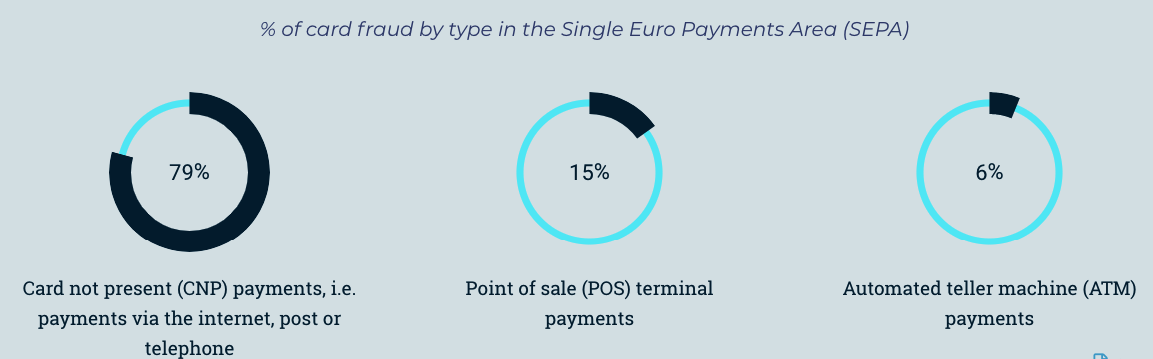

Card Not Present (CNP) transactions are the payment method with the highest rates of fraud in Europe, taking up 79% of total fraudulent payments. Not only is this exceptionally high, but the numbers are increasing every year – which is not the case for ATM or Point of Sale fraud.

Why are CNP payments so prone to fraud? Nowadays, anyone can buy over millions of stolen credit cards on the dark web and use them to make online purchases. These fraudulent CNP purchases are often anonymous and international, which makes them harder to trace. Since eCommerce fraud is usually not a priority for law enforcement, most fraudsters are never pursued.

Card fraud is very expensive for merchants. When someone pays with a stolen credit card, it’s not just the customer that becomes a victim – but also the merchant. That’s because when a chargeback occurs, merchants are obliged to refund the purchase as well as pay additional fees to the card network.

Disputing a chargeback claim is so time-consuming and expensive, that fraudsters are relying on the fact that merchants will refund the purchase rather than dispute it with the card network. Because of this, retailers are expected to lose $130 billion between 2018 and 2023 due to online payment fraud.

In addition to the high rates of fraud, merchants are having to battle with the fact that debit and credit cards are taking an even bigger cut out of their revenue. According to a survey by BCR, cards account for 61% of retail transactions, but take up an astounding 83% of retailers’ cost of collection, and 35% of total payment costs.

This is not even considering the fact that in 2021, Visa and Mastercard will be increasing merchant fees later this year, going as high as 2% for certain customer credit card purchases. Since PSD2 banned surcharging (charging extra fees for cards) in 2018, merchants have limited options when it comes to decreasing payment costs.

👉 Find out more: Everything you need to know about Payment Initiation

3 ways bank transfers prevent fraud

Considering all the issues that come with debit and credit cards, direct bank transfers offer a solution to help eCommerce businesses combat fraud on three fronts:

1. More security

Direct bank transfers that utilize Open Banking are completed via banking applications. This means customers don’t need to input usernames or passwords in order to complete a payment, limiting the amount of sensitive data typed into online forms and helping keep customer credentials private.

Only licensed third parties can share financial information and push payments with bank transfers, which reduces the likelihood that a middleman or third party is fake.

Finally, bank transfers often require payments to be confirmed with biometrics or a customer’s face, which are both authentication methods that are incredibly hard to replicate.

2. Better customer experience

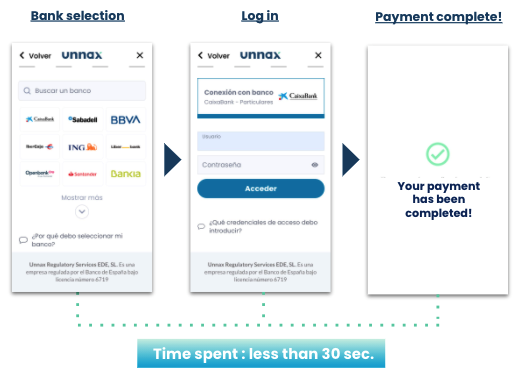

Bank transfers offer a much more intuitive, frictionless payment experience. Instead of typing in card numbers or PINs, customers can just pay using biometrics through their bank account. With an Open Banking enabled widget, the payment initiation is automated from start to finish.

Not only that, but merchants are effectively in control of the entire payment experience and UX. They can design a more trustworthy onboarding experience with fewer required clicks and faster transaction times. If a customer feels the payment experience is secure and trustworthy, they are less likely to backtrack and more likely to complete the payment.

Read more: How eCommerce can upgrade payment technologies with Open Banking

3. Fewer chargebacks

Chargebacks are the ultimate headache for merchants: they negatively affect the reputation of a business, are expensive, and take up a lot of time and energy to resolve.

With direct bank transfers, chargebacks become less common. Since bank transfers happen directly from a customer to a merchant account, card networks can be bypassed. As customers authenticate the payment from their bank account, it’s a lot less likely they forget about a purchase and demand a refund.

If a customer needs a refund, the situation is managed by the merchant rather than the card network. This helps decrease chargeback fraud and makes it a lot easier to keep track of all refunds and returns.

With more people shopping online than before, eCommerce companies should be perfectly placed to benefit – but payment fraud looms in the background. With payment technologies such as APIs and Open Banking, merchants finally have a way to ride the boom of online shopping without accounting for an increase in fraud.

Find out here how you could build better financial products using banking data and smart payment technologies with Unnax.