Embedded Finance and Embedded Banking are on the rise, with no signs of slowing in the next five years.

From 2023 to 2029, the global Embedded Finance industry is forecast to grow at a 32.9% CAGR, with predictions of Embedded Finance revenues topping $31.8B by the end of 2029.

With a clear trend of steady growth, the Embedded Finance market offers lucrative opportunities to establish effective and profitable Embedded Banking solutions. To leverage Embedded Banking’s maximum potential, your business must answer one simple question:

Should you build or buy an Embedded Banking platform?

Build vs. Buy: Comparing your options for implementing Embedded Banking

Embedded Banking solutions require the proper compliance infrastructure and resources to operate smoothly.

When adding Embedded Banking to your business value proposition, choosing between an in-house platform build and a third-party platform purchase is the first major decision to make.

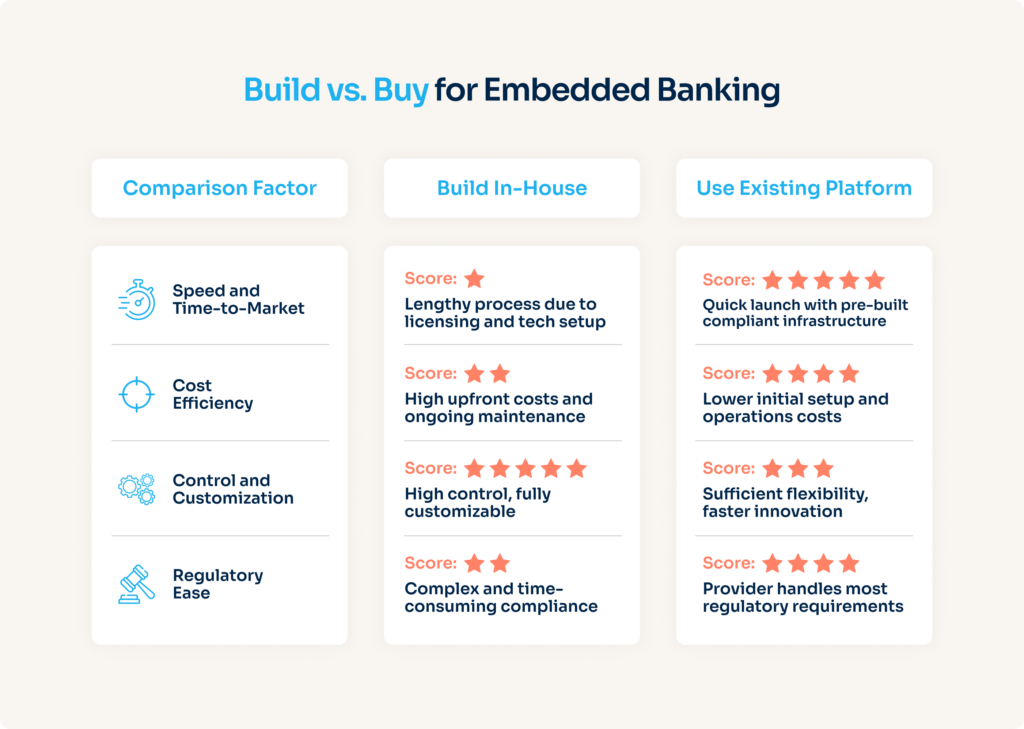

Let’s compare platform builds and buys across four key factors:

1. Speed and time-to-market

To build an Embedded Banking platform in-house, you must have the proper licensing. In the EU, for example, a licensed electronic money institution (EMI) can act as an Embedded Banking provider because it has the legal authority and capability to manage and control the technological aspects required for Embedded Banking solutions, ensuring they are functional, secure, and compliant with regulations.

In addition to an EMI license, which can take months and even years to acquire, building an in-house platform requires dedicated technical development and operational and compliance teams that demand considerable time to onboard and train. Such talent requirements can be quite a resource strain for smaller companies.

Comparatively, buying an existing platform typically affords you a faster time-to-market, as your chosen platform provider bears the responsibility of licensing and technical staffing. With a white-label, compliant Embedded Banking platform, the infrastructure is already established and ready for integration.

2. Cost considerations

Developing an Embedded Banking platform in-house can impose significant upfront costs, particularly when sourcing the right technical infrastructure and resources. Beyond development, regulatory requirements add further costs and complexity, demanding dedicated compliance teams – with specialized knowledge – to navigate licensing, data protection, and ongoing oversight.

In addition to these upfront expenses, an in-house platform also requires long-term and ongoing technical maintenance, which can substantially increase monthly operational costs.

By contrast, when you work with a platform provider of an existing Embedded Banking platform, you gain the advantage of much more cost-effective initial setup processes and long-term operations. Compliance and technical support are typically included, reducing the need for internal resources.

3. Control and Innovation

Maintaining total control and customization of an Embedded Banking platform can be appealing, drawing many to the idea of building their platform in-house.

However, while building your own lends itself to a fully tailored experience, pre-existing Embedded Banking platforms still offer many valuable features, such as IBAN accounts, virtual IBAN issuing, and payment solutions.

With white-label Embedded Banking platforms, you can build and embed financial features into your product more quickly and easily. Implementation cycles are far shorter, giving you much more freedom to focus on building the best customer experience, innovating, and addressing industry trends as they occur.

4. Regulatory compliance

Building an Embedded Banking platform entirely in-house requires proper licensing, such as an EMI license. Depending on the financial products you want to provide, you may also need additional licenses. For instance, to offer account-to-account payment services in the EU, you’ll also require a Payment Initiation Service Provider License (PISP).

Yet, a license is only the tip of the iceberg when it comes to the many regulatory standards you will be expected to meet. Ensuring compliance with self-built solutions requires hiring a team of legal and security experts with experience in banking technology and KYC & AML processes, which is not only challenging but also expensive and time-intensive.

Choosing to work with a licensed technology provider instead helps you side-step a large chunk of this regulatory process. While you will still have compliance obligations to honor, you can leverage the licensed capabilities of your technology provider to offer your customers satisfactory Embedded Banking experiences from a secure digital environment.

Making the decision: Will you build or buy?

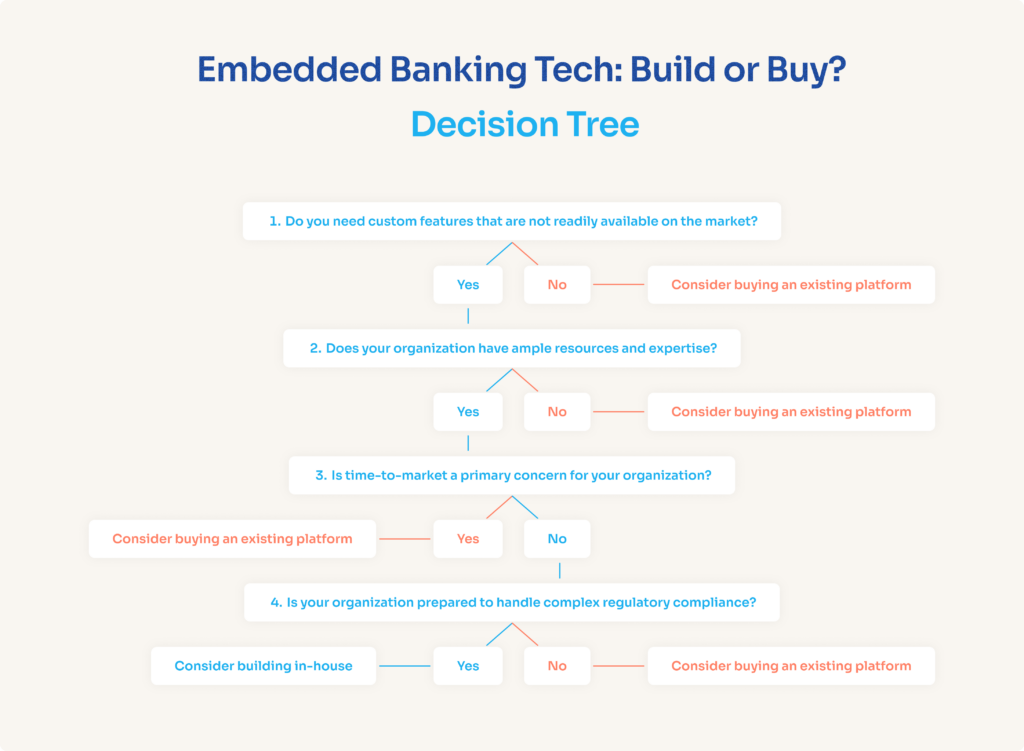

Keeping in mind the four factors discussed above, you must make an informed decision regarding which implementation option is right for your Embedded Banking platform project.

Here are our recommendations as an established Embedded Banking and Open Finance provider:

- Who should build: Building an Embedded Banking platform from the ground up requires significant upfront investments in talent, resources, and licensing. This approach is recommended only for large organizations that prioritize innovation and differentiation through features that must be highly customized to meet specific needs, such as a unique design or a sophisticated back-office interface that integrates multiple services. Such organizations should have ample resources and a clear strategic vision for long-term growth.

- Who should buy: Using an existing Embedded Banking platform can offer you much of the same flexibility and customization options without spending all of your resources on upfront costs. By choosing your technology partner wisely, you can scale your platform quickly by leveraging their established platform infrastructure and industry expertise. Plus, buying an existing platform can help you reduce risk and optimize end-user experiences.

Pedro Garcia, CEO and co-founder of Unibo, the first digital account created for commonholds designed by and for property managers who currently manage 80% of the buildings in Spain, highlights the advantages of leveraging an Embedded Banking platform like Unnax rather than building one yourself:

“All that complexity is taken away from you, and you can create a project on top of that layer of security, regulation, and technology that Unnax has already created.”

Read more: How Unibo’s Leveraged Unnax IBAN Accounts to Achieve 15X Growth in Just One Year

Develop innovative Embedded Banking solutions with Unnax

At Unnax, we provide our clients with an Open Finance and Embedded Banking environment perfect for building frictionless financial experiences. As a licensed EMI, we deliver a fully compliant infrastructure that supports use cases like:

- Real-time credit decisioning and automated payment flows in lending

- Transaction reconciliation and streamlined collections for ERP systems, enterprise management tools, and proptechs

Our solutions are designed to meet the operational needs of these sectors, simplifying complexity, enhancing compliance, and accelerating growth.

“After implementing Unnax services, we have noticed an increase in our ability to scale our business while maintaining service stability and, above all, customer satisfaction.” — Miguel López de Luca, Country Manager at Blue Finance