At the beginning of 2021, we wrote about the evolving regulatory landscape in that year, mainly consisting of PSD2, 3DS2, the increase in Open Banking enabled payments, and the fact that banking as a service was becoming more mainstream.

We predicted that Open Banking would play an increasingly important role in payments around the world, but has this happened? So far, different countries are reporting different numbers. In the UK’s Open Banking 2021 report, the OBIE noted a slower pace of growth, with Open Banking’s most prominent use cases being in decision-making, payments and borrowing. However, more consumers are using Open Banking than before: 7.5% to 8.5% of consumers are estimated to be users of at least one Open Banking service, up from 5 – 6% in December 2020.

According to a Paypers report, the European Economic Area has reached over 500 million Open Banking enabled transactions per month. Although they are mainly for account information services (AIS), we are also seeing an increase in account to account (A2A) payments.

So what’s happening in 2022? Here are some of the biggest Open Banking trends we see taking the stage next year.

The 4 main Open Banking trends that will shape 2022

More Personal Finance Management (PFM) apps

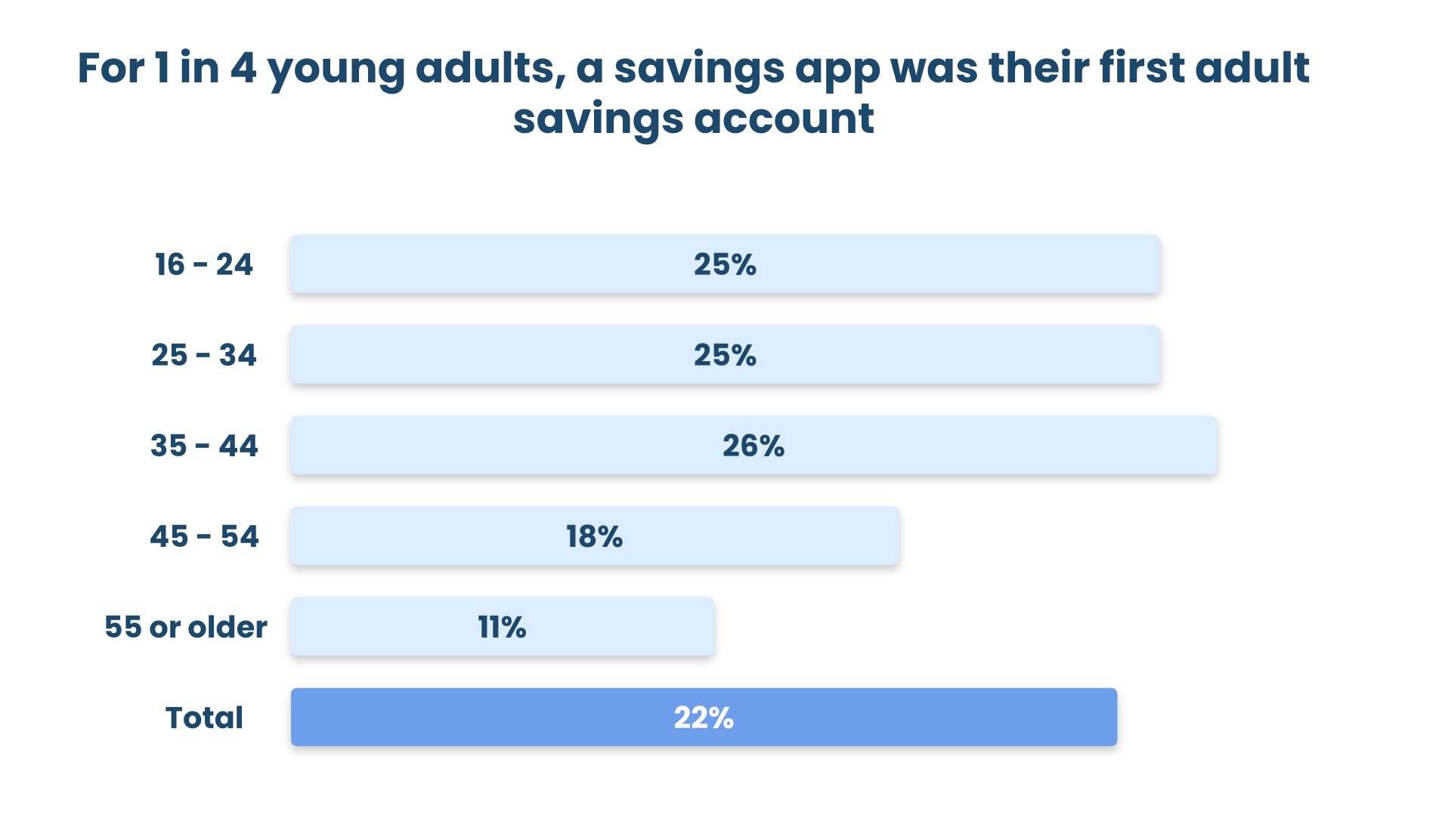

The results are in: PFM apps definitely help customers save and manage their money. According to an Open Banking survey, 36% of PFM customers rated their likelihood to continue to use the service at the highest possible level. There is proof that PFM apps encourage positive habits and behaviours when it comes to consumers managing their finances.

With Open Banking, we expect to see more PFMs come to the market. Why? Because Variable Recurring Payments (VRP) will be an important Open Banking development in 2022 which will help PFM apps offer an even better product to consumers. With VRP, bank users will be able to use “sweeping” to transfer money between their various accounts automatically, helping them to avoid overdraft fees and build up their savings accounts.

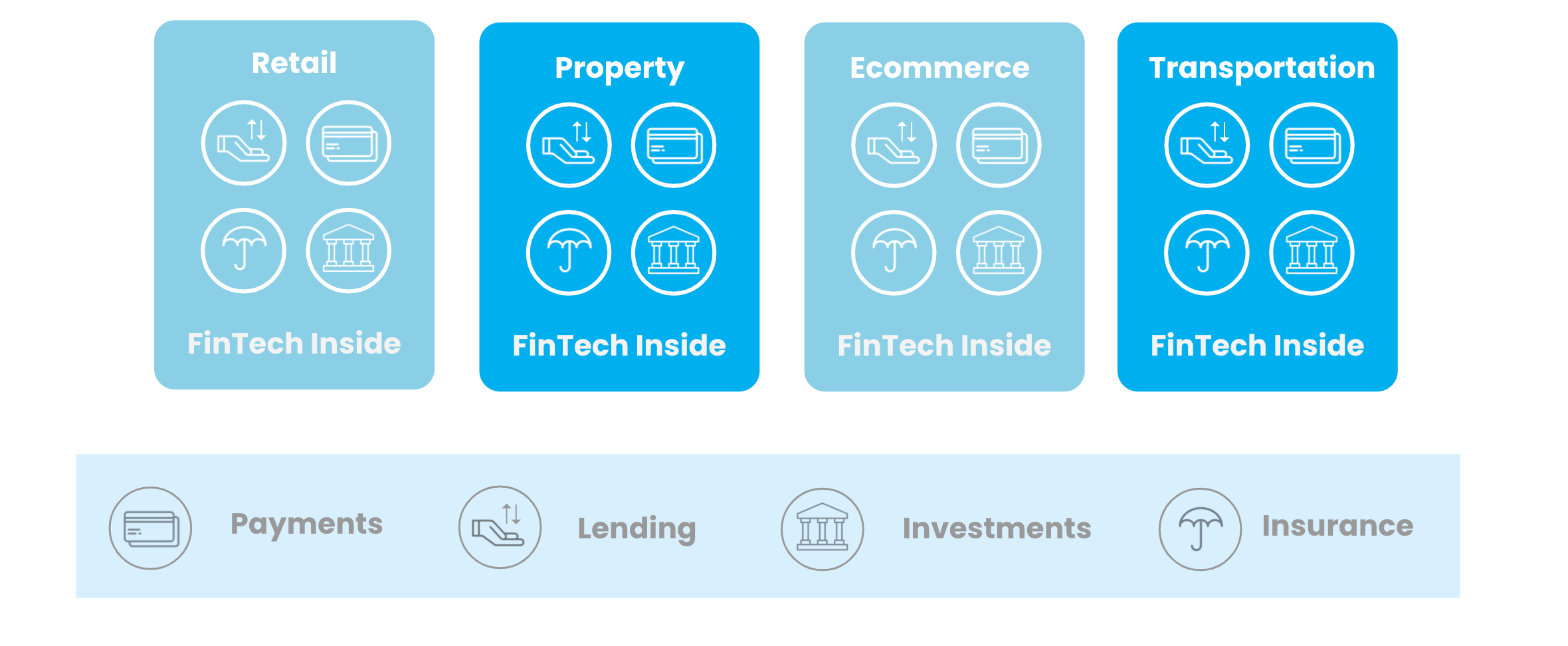

The growth of embedded finance

Embedded finance was a key trend in 2021, and will continue to be in 2022. We’re seeing both the demand and supply side of embedded finance growing.

On the demand side, more customers are demanding integrated experiences and financial services that are embedded into their purchases. For this reason, more companies are considering getting into financial services to better serve their customers as well as add an additional revenue source to their business. Companies like IKEA, for example, bought a 49% stake in Ikano bank with the goal of offering a full suite of banking services to customers.

On the supply side, more financial institutions are offering banking as a service than ever, for a few reasons. With PSD2, banks are being forced to better develop their banking APIs. Since many banks are already developing APIs to follow PSD2 rules, it’s logical to monetise them by offering Banking as a Service to fintech companies and merchants. With banking revenue declining, banks are looking elsewhere for new revenue streams and are redefining the banking business model.

👉 Read more: Everything you need to know about Embedded Finance

Implementing of Recurring Payments

Recurring payments essentially works just like a direct debit, but it is initiated by the customer rather than the merchant — which is why they are often called “smart direct debits”. With Recurring Payments , customers are able to choose when to begin and end a payment with a merchant, which removes the need for paper-based agreements. Most importantly of all, this payment method only requires completing SCA once, when the mandate is first established. Every payment after that doesn’t require authorization.

Since they are enabled on Open Banking, payments are 93% cheaper than card payments, settlements are less than 72 hours, and they are a lot more secure since merchants don’t need to store any personal details and therefore are not prone to data breaches.

In the UK, banks and licensed third parties will be testing an upgrade of this method called Variable Recurring Payments (VRP) in the first half of 2022 with the aim of implementing it in July 2022. The rest of Europe is still a little further behind but will begin testing with VRP in 2022 as well.

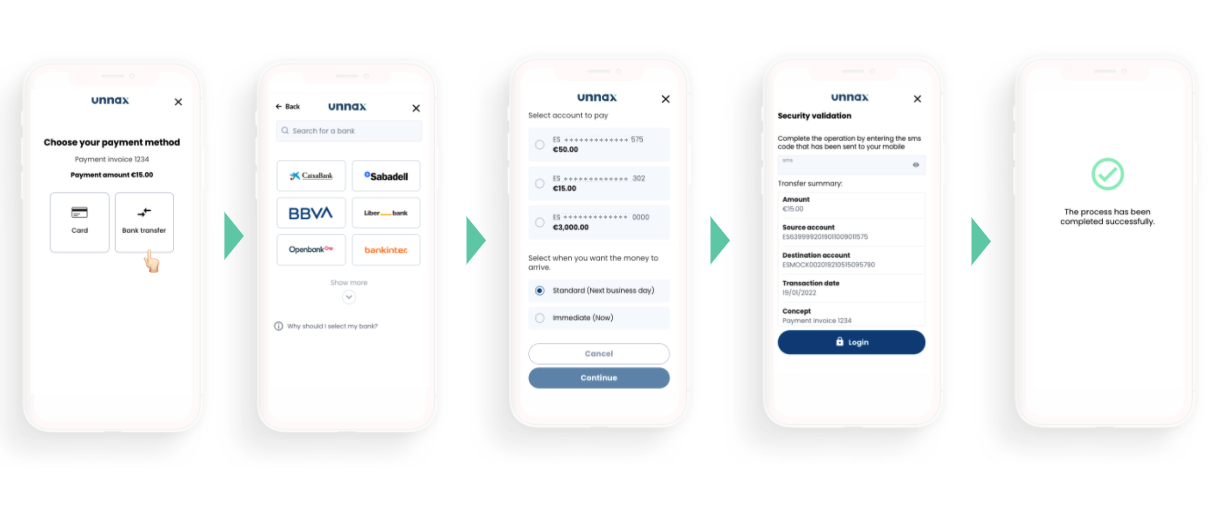

An increase in Direct Bank Transfers

Although account information services were more prominent in 2021, we’ll likely see many more merchants using Open Banking for payments in 2022.

In terms of open banking trends, we’ve already seen Amazon announce that they’ll stop accepting Visa credit cards issued in the UK from January — mainly due to the high fees. This might cause Amazon to shift to another model such as direct bank transfers, also known as account to account payments (A2A).

All in all, it’s still expensive for merchants to take card payments, and more consumers than ever are willing to pay via Open Banking today. This is the case especially for everyday payments like groceries, whilst consumers are comparatively less inclined to use open banking payments for large ticket items like holidays.

Worldline is predicting that in Europe, A2A will reach 10% penetration within five years, with Capgemini describing direct bank transactions as a pressure point on bank payment strategies. All things considered, we believe Open Banking payments will reach increased adoption in 2022.

👉 You may like: Everything you need to know about payment initiation

Open banking trends set to benefit users and companies

2022 is set to be an exciting year for Open Banking, as adoption increases and more merchants start implementing A2A payments for online payments. More Open Banking technologies like VRP will help subscription-based businesses as well as improve the user flow by removing SCA. We’re looking forward to seeing more use cases for Open Banking as well as more companies taking advantage of Open Banking technology in 2022.