Is your method for validating customer bank accounts due for an upgrade?

The account ownership validation process has evolved significantly, moving away from manual verification and outdated database checks. Today, instantaneous account ownership verification is a critical component of secure financial operations, allowing businesses to confirm account ownership without unnecessary friction.

While Open Banking has played a role in enabling better access to financial data, it still comes with limitations. Businesses relying on PSD2-based verification must process 1-to-1 requests, require explicit customer consent, and depend on customer interactions, making the process slower and less efficient for recurring customers.

To address these challenges, Unnax introduces Valitic, an advanced API-based account ownership verification solution powered by Iberpay, the entity that manages Spain’s National Electronic Clearing System (SNCE).

Let’s explore how Valitic revolutionizes bank account verification and why it’s the most efficient and secure alternative to traditional methods.

What is bank account verification?

Bank account verification (also known as account validation) is the process of confirming that a bank account exists and belongs to the person or business claiming ownership. This is essential in various financial processes, including lending, payments, fraud prevention, and regulatory compliance.

Accurate verification helps businesses:

- Ensure financial transactions are processed securely

- Reduce fraud and identity theft risks

- Streamline customer onboarding

- Eliminate costly payment errors

With Valitic, businesses can verify account ownership instantly and without requiring customer interaction, ensuring a seamless and fraud-resistant experience.

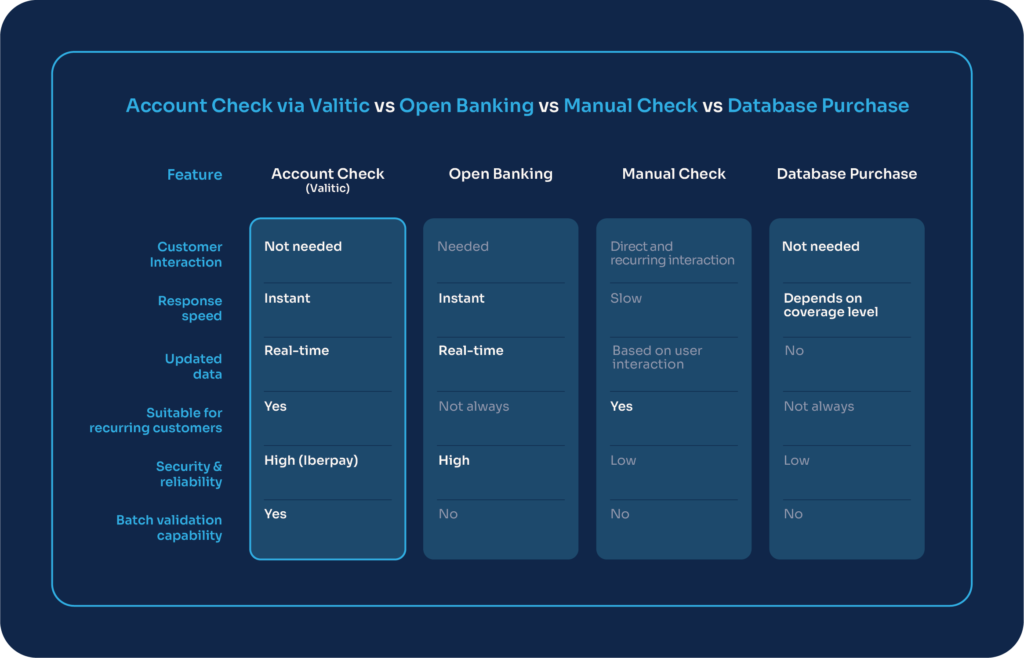

How does Valitic compare to other verification methods?

Many businesses still rely on manual account verification, which involves collecting documents, cross-checking details, and manually approving transactions: a slow, error-prone, and inefficient process.

Open Banking (PSD2) improved the verification process by enabling financial institutions to access customer data in real time, but it still requires:

- Customer consent before data can be retrieved

- Direct user interaction, adding friction to the process

- Processing of individual requests, making it inefficient for bulk verifications

Valitic eliminates these issues by providing:

- Real-time account ownership verification

- Automated processes that eliminate manual reviews

- Seamless API integration with ERP, CRM, TMS, and other back-office systems

- No need for customer interaction, just IBAN and identification number

The table below illustrates how Valitic compares to Open Banking, manual checks, and database purchases:

Unlike Open Banking, which is best suited for new customers, Valitic is the ideal solution for recurring customers, bulk validations, and high-volume financial operations.

Why is bank account verification important?

Verifying account ownership is essential for financial security, operational efficiency, and fraud prevention. Here’s how Valitic helps:

- Customer onboarding: Automate account ownership verification, reducing fraud risks and accelerating onboarding.

- Payment and collection processes: Ensure accurate account holder identification, reducing payment failures and manual errors.

- Secure payment issuance: Validate account details in real time, preventing fraud and ensuring seamless transactions.

- Database updates: Keep account ownership records updated, reducing failed payment attempts and associated costs.

Who should use Valitic? Five key use cases

1. Credit & Lending

For lenders, verifying a customer’s bank account ownership is crucial for assessing financial reliability, preventing fraud, and ensuring payments are processed to the correct account.

2. Insurance

Insurance companies must accurately assess risk and prevent fraudulent claims. Valitic ensures secure premium collection and accurate payout processing.

3. Marketplaces

Online marketplaces require secure transactions between buyers and sellers. Valitic validates account ownership, reducing chargebacks and unauthorized transactions.

4. Gambling & Gaming

Gaming and gambling platforms operate in a high-risk environment. Valitic ensures compliance with financial regulations by validating user accounts before processing deposits and withdrawals.

5. Any business handling financial transactions

If your business manages customer payments, collections, or refunds, Valitic eliminates errors, fraud risks, and inefficiencies, improving overall security and compliance.

Valitic: The most reliable API-based verification solution

Valitic, powered by Iberpay, provides businesses with a 100% digital, real-time, and frictionless account ownership verification solution.

Key Features:

- 99% market coverage: Verify ownership of over 80 million Spanish IBAN accounts.

- Real-time verification: Available 24/7 with instant responses.

- 100% digital process: Easily integrates with ERP, CRM, and TMS systems.

- No customer interaction required: Validate accounts without consent requests.

- Maximum security and reliability: Built on Iberpay’s National Electronic Clearing System (SNCE).

What you get with Valitic:

- Prevent fraud and identity theft by verifying IBAN ownership.

- Automate processes and eliminate manual reviews.

- Ensure secure payments by confirming the sender and recipient.

- Reduce payment failures with regularly updated account ownership records.

- Accelerate onboarding by automating IBAN verification.

Start using Valitic today

Are you ready to eliminate payment errors, reduce fraud, and accelerate account verification?

Let’s talk. Book a demo and see Valitic in action.