As of June 2022, banks in Spain reported a massive volume of non-performing loans — 78.87 billion euros worth, to be exact. When measured against the entire European Union, Spain’s volume of non-performing loans represents an astounding 21% of the EU total.

Non-performing loans are a major challenge for the lending industry as a whole, but especially for credit entities in nations experiencing high levels of economic uncertainty, such as Spain and Italy.

Overcoming this challenge comes down to prevention. How can lenders lower their NPL ratios and inhibit new incidents of NPLs from occurring?

The key to NPL prevention comes down to two key factors: understanding borrowers on a deeper level and adopting better solutions for accessing customer account data.

Let’s begin by first defining what, exactly, an NPL is.

What is a non-performing loan?

A non-performing loan (or NPL for short) is a type of loan where the borrower does not uphold the financial obligation they agreed to as part of a loan contract. According to the International Monetary Fund (IMF), all the following examples are NPLs:

- Loan payments that are overdue by 90 days or more

- Interest payments equal to 90 days or more that have been capitalized, refinanced, or delayed by agreement

- Loan payments that are less than 90 days overdue but include other indicators of an NPL, such as the borrower filing for bankruptcy

Causes of non-performing loans

NPLs can occur in all industries and at both individual and business levels.

According to a recent Spanish and International Economic & Financial Outlook (SEFO) report, the occurrence of NPLs has actually decreased in recent years, despite NPL ratios in Spain being higher than the EU average. This is attributed in part to the economic measures rolled out during the Covid-19 crisis to help businesses and households stay afloat.

However, though the strains of the Covid-19 crisis have diminished, new pressures from the geopolitical climate in Europe are impacting the NPL ratios in all sectors. The ongoing high energy prices are also likely to affect the overall creditworthiness of businesses. And of course, private individuals are suffering too, with high inflation increasing their costs and elevated interest rates, making lending more expensive for them.

As the SEFO report further states:

“ — tighter financing conditions will impact both business lending (the SME segment being more vulnerable, starting from higher levels of non-performance) and household lending (rate increases), which will affect their ability to service their debts and ultimately impact non-performing loan ratios.”

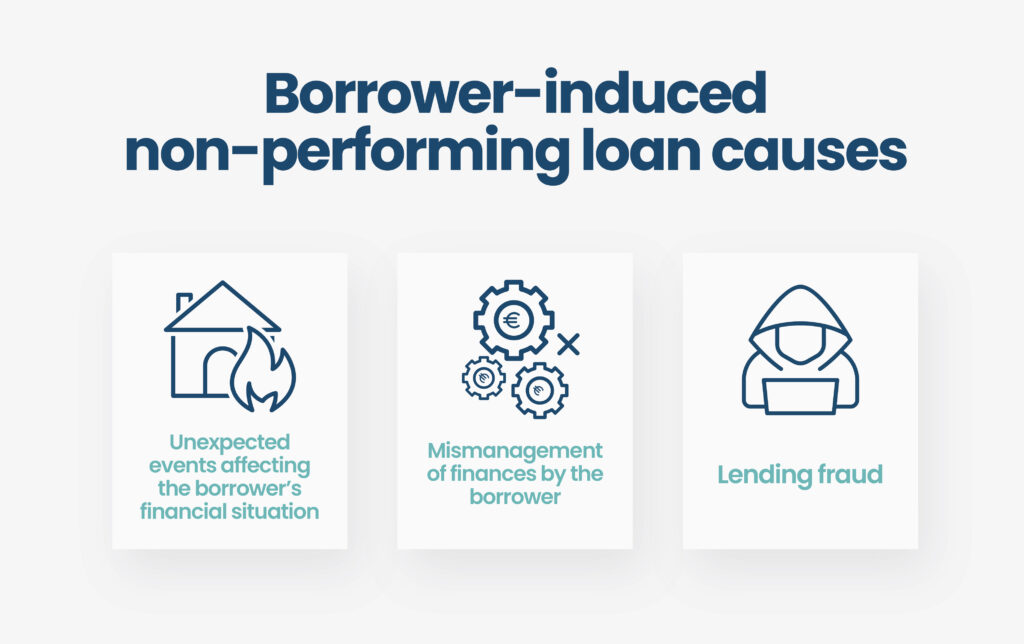

Borrower-induced non-performing loan causes

On the borrower’s side, NPLs typically occur during times of economic hardship when an individual or business is struggling to keep up with payments. Reasons for this can range from sudden, unexpected events to simple mismanagement of their finances. Fraud can also be a cause.

Unexpected events affecting the borrower’s financial situation

In this case, a borrower may have a favorable risk profile and do their best to manage their finances well, but an unforeseen event severely affects their situation. This can either be a loss of income or a rise in costs. For instance:

- Losing a job

- Loss of income sources

- Spike in costs that aren’t fully covered by insurance. For example, a severe natural disaster that damages the borrower’s home

- Illness requiring costly treatment

Mismanagement of finances by the borrower

While the aforementioned factors can be put down as “bad luck”, poorly managed household accounts are often self-inflicted causes for financial struggle. The most common example is people living a lifestyle beyond their means or running into bad habits like gambling or over-shopping. Of course, sometimes managing household finances is an uphill battle that is hard to win despite the borrower’s best intents, especially for those with lower incomes who are already struggling and living paycheck-to-paycheck.

Lending fraud

Lastly, lending fraud can cause non-performing loans, which is a hugely prevalent issue. In fact, as we state in our article on the different types of lending fraud and how to overcome them, small business lending fraud has increased by 6.9% since the pandemic started. PwC’s Global Economic Crime and Fraud Survey 2022 also revealed that 51% of the 1,200+ survey respondents had experienced fraud at their organization in the past two years.

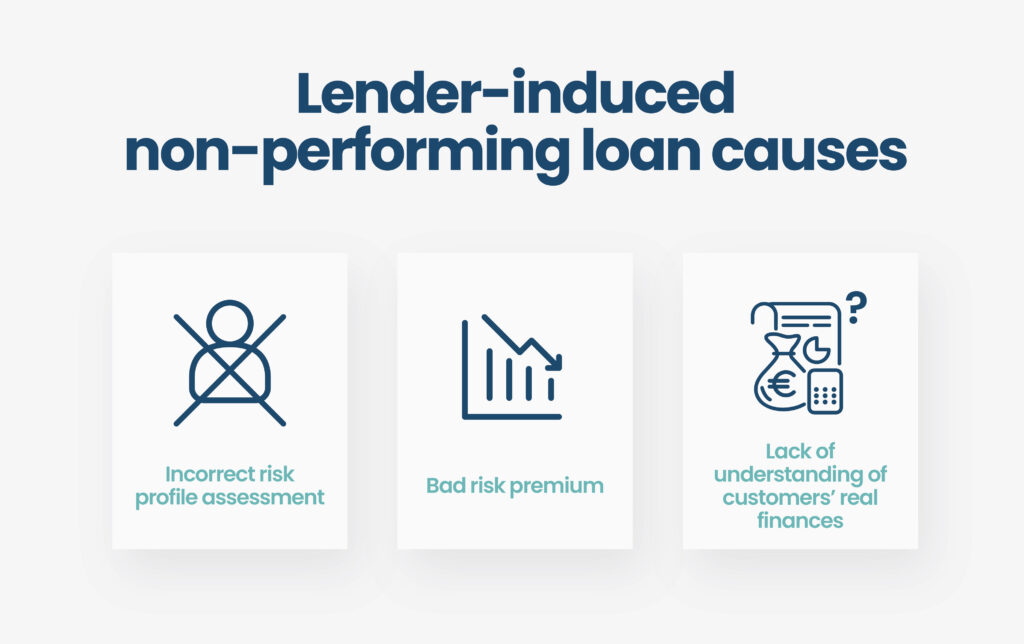

Lender-induced non-performing loan causes

From the lender’s side, the trigger behind non-performing loans can vary per segment but generally comes down to a lack of deep customer understanding. Common causes include an incorrect risk profile assessment, bad risk premium, and a lack of understanding of customers’ real finances.

As mentioned above, some of the causes from the borrower’s side are down to chance, so lenders must factor these into their risk premiums and asset guarantees in case of default or missed payments.

Lenders must ensure that they can see the full financial picture of a loan applicant and gain a comprehensive understanding of their financial behavior. This enables them to not only properly assess the financial situation of the borrower, but to consider whether the borrower’s behavior makes them a suitable person for the loan.

👉 You may like: Decisioning: what it takes for lenders to make accurate credit decisions

The impact of non-performing loans for lenders in Spain

The SEFO report discussed earlier highlights that the small-to-medium enterprise (SME) segment makes up the largest portion of NPLs in Spain, with the ratio sitting at a consolidated 6.7% as of Q2 2022. SME non-performance accounts for 44% of the total business NPL volume in Spain.

The next biggest NPL ratio in the lending segments belongs to non-financial corporations (4.36%), followed by household lending (3.57%), and mortgages (2.71%).

Additionally, Spain has some of the highest NPL ratios in the EU, dwarfed only by Italy whose consolidated NPL ratio sits at 7.22%.

High NPLs have a big impact on lenders themselves, including:

- Loss of revenue

- Increased costs resulting from trying to recover funds

- Lower profits

- Lower capacity to offer loans to a larger pool of applicants

- Reduced competitiveness

- Having to charge higher rates

How Unnax can help reduce non-performing loans

To mitigate the impact of NPLs in Spain, lenders must focus on assessing borrowers on a much deeper level and do so on a continuous basis to make better decisions. This is particularly important for recurring customers, where lenders need to continuously access and review the borrower’s payment capacity over a prolonged period.

At Unnax, our recurring account aggregation technology provides lenders with the foundation to do exactly that. We enable them to obtain a truly accurate and holistic financial picture of loan applicants and not just once as part of an initial assessment, but continuously over an extended amount of time. This provides four main benefits:

- Accessing real-time financial data to get the most up-to-date information instead of using figures based on outdated documents

- Ensuring a higher quality of data by receiving it directly from digital bank accounts rather than from printed documents or scans that are susceptible to fraud or manual input errors

- Receiving a complete financial picture of borrowers by aggregating their entire financial accounts

- Receiving updated contact information whenever borrowers change phone numbers, email addresses or residence to ensure the highest reachability

- Monitoring borrowers’ account balances to optimize debt collection strategies

But while account aggregation provides you with the most accurate and complete financial data of borrowers, we can do even better than that. With our categorization and financial indicator solutions, you can take things to the next level, allowing you to fully understand a borrower’s financial behavior to make the best loan decisions:

- Categorization: Delivers strong insights into how much your applicants spend on specific aspects of their lives, such as housing, utilities, and leisure.

- Financial indicators: Enable you to use the data you receive from account aggregation and categorization to calculate financial metrics that effectively illustrate your applicant’s financial health and behavior. This includes metrics on the customer’s payment capacity, gambling index, and more.

Ultimately, with Unnax’s full suite of solutions to non-performing loans, a lender’s decision-making becomes faster, more efficient, and a lot less risky, helping them achieve much lower rates of NPL.

Start reducing your NPLs by talking to our sales team today.