Do the challenges of payment collections over-encumber your business?

As the lifeblood of any enterprise, an efficient collections process is not just about maintaining liquidity but also ensuring long-term growth and stability. An unoptimized approach to collections can lead to many operational hindrances that disrupt your business’s bottom line.

To provide you with the streamlined financial operations you need, Unnax offers a variety of payment collection methods to enhance your business efficiency and deliver exceptional customer experiences.

What are payment collection methods?

Payment collection methods broadly refer to the technology, software, and tools used to collect customer payments. These methods range from traditional invoicing and wire transfers to contemporary approaches like direct debits and online payments.

Finding the right payment collection method can be tricky depending on your specific business use case and the regulations in your region. As a result, many organizations turn to financial service providers to facilitate the collections process, offering key features such as:

- End-to-end automation

- A completely digital experience

- Exceptional integration capabilities with other accounting tools

Which payment collection methods does Unnax offer?

As a leading Embedded Finance provider, Unnax offers all the key features you need for a payment collections process tailored to your business’s precise needs. Along with fully automated collections, the Unnax suite of collections solutions is 100% digital and easy to integrate with your other tools.

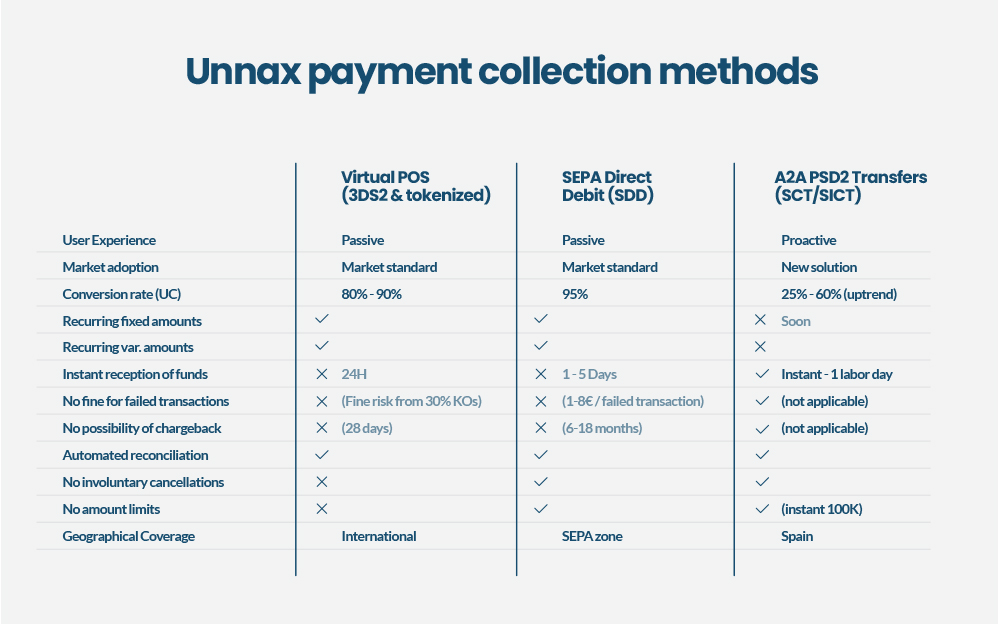

To best serve the SEPA zone, Unnax offers three main payment collection methods:

1. Virtual POS

A virtual point-of-sale (POS) is a payment processing system used to accept online payments.

These payments are entirely remote and are one of the most popular payment methods on the market today. Oftentimes, a virtual POS can accept multiple payment methods from the customer, including traditional card payments and digital wallet payments.

At Unnax, our virtual POS solution offers worldwide coverage. As with all collections in these circumstances, transaction amount limits are set by the customer’s bank. Key advantages of Unnax’s virtual POS solution include:

- Secure card payments compliant with 3DS2, PSD2, and SCA

- The ability to validate card payments with a €0 charge before processing the transaction

- Automatic management of full and partial refunds

2. SEPA core direct debit

SEPA core direct debit is the third most common payment method in Europe. This payment collection method enables organizations to pull funds directly from a borrower’s account and credit them into the business’s account with no transaction amount limits and is commonly used to facilitate recurring payments.

For businesses operating in the SEPA region, SEPA core direct debits are an especially crucial payment collection method to have access to. Unnax SEPA core direct debits ensure your payment collection process can operate smoothly within the SEPA region with key features, including:

- Full coverage across the SEPA zone

- In contrast to vPOS, no involuntary rejections due to card loss, theft, cancellation, or expiration occur

- All you need to do is have the customer sign the mandate. Everything else is automated.

You may like: How Unnax Supported Esmiluz Energía In Managing Over €150K Remittances in a Single Month

3. Open Banking payments (A2A)

In Spain, Open Banking payments (also called account-to-account, A2A payments or PSD2 payments) are a new way to collect payments via bank transfers.

These payments are one-time transactions made via either an instant or regular bank transfer. A2A enables the processing of bank transfers without customers having to leave the merchant site. While this offers great convenience, you need the proper connections to participating banks in Spain to use this payment collection method effectively.

Luckily, Unnax has you covered — our Open Banking payment collection method for Spain offers a variety of useful features, including:

- No transaction amount limits for regular transfers and up to €100,000 for instant transfers

- No involuntary rejections occur due to card loss, theft, cancellation, or expiration, which is in contrast to vPOS

- In contrast to direct debits, there is no possibility of chargebacks once the payment executes

How Unnax’s automated collection campaigns benefit your business

At Unnax, our portfolio of payment collection solutions gives you the advantage of streamlined financial operations that boost your collection process efficiency and heighten customer satisfaction.

Seamless integrations

Seamless integrations are one of the major reasons businesses choose us over traditional providers. We understand that a comprehensive internal finance system involves many moving parts. To accommodate your unique suite of tools and software, we seamlessly integrate with accounting and financial management systems.

Having these payment solutions integrated massively reduces your manual operations, as you’re no longer uploading files into banking systems, and also facilitates automated reconciliation. Again, saving countless man-hours.

Scalability, visibility, and a better user experience

With Unnax’s automated collection campaigns, your business also benefits from:

- Operational scalability: Unnax’s payment collection solutions handle large transaction volumes, allowing you to scale up your business with complete operational peace of mind. Thanks to our EMI license, you’ll be able to collect payments throughout the SEPA area and with the support of our European license, you’re able to facilitate strong growth across Europe.

- Real-time status visibility: Through the Unnax API, your business gains access to real-time status updates. With our technology, you can view the real-time status of every single transaction, providing you with a more precise analysis to use in your decision-making processes.

- Improved user experience for better collection: Let your users select their preferred payment method and optimize the collection process further.

Choose Unnax for streamlined payment collections

Unnax provides tailored products for businesses operating in the SEPA region. Our platform and technology allow you to safeguard funds within your Unnax account and conduct automated collection campaigns with exceptional ease.

Contact Unnax today to discover how we can help you optimize your collections strategy.