If you oversee the development and growth of a cryptocurrency platform, you’re always on the lookout for cutting-edge techniques and services that can help improve your business. And with the ever-changing landscape of legislation and regulation, it’s a good idea to leverage emerging opportunities to stay ahead of the game.

In this article, we’ll take a look at crypto platforms, their main challenges including those from a legal standpoint, and how Banking-as-a-Service (BaaS) providers can help overcome them.

Read straight through, or jump to the section you want to read:

- Context: What is a crypto platform?

- Legal framework for crypto platforms in Spain & Europe

- How can Banking-as-a-Service serve crypto platforms?

- What are the benefits of having Unnax as a technology and regulation partner?

- Team up with Unnax to grow and stop worrying about regulation

Context: What is a crypto platform?

Context: What is a crypto platform?

First, let’s define what we’re referring to when we employ the term “crypto platform.” At its most basic, a crypto platform is an online system that provides services like trading and exchange for various crypto assets, including cryptocurrencies, tokens and NFTs.

There, users can store, purchase and exchange cryptocurrencies with others. Token issuers who use this type of service can also take advantage of its features to transfer their tokens rapidly and easily.

While some crypto platforms simply act as intermediaries between buyers and sellers of cryptocurrencies, others offer investment opportunities.

Why do we need regulations for crypto platforms?

Crypto regulations are needed to protect consumers and prevent money laundering. As cryptocurrencies gained popularity, the number of platforms grew exponentially. Today, you can easily find reliable and secure platforms that allow users to buy and sell these virtual currencies. Unfortunately, consumers and businesses can just as easily fall prey to a scam or a cyberattack.

Some common scams we’ve seen over the years include websites that ask for your private key or seed words. This way, they can access users’ funds and send them to their own wallets. We also frequently see phishing scams where cybercriminals create fake web pages with logos similar to those of major crypto platforms.

Finally, the pump and dump of alt-coin schemes happen when the price of a coin is artificially inflated and then dumped, which can cause enormous losses for anyone who holds that particular coin. Without adequate regulations, these kinds of common attacks are hard to avoid.

Legal framework for crypto platforms in Spain & Europe

Legal framework for crypto platforms in Spain & Europe

At the moment, there is no homogenous legislation in Europe and, at a national level, crypto platforms are either barely regulated or not at all.

To address this issue, the European Union is currently working on new laws/regulations around crypto exchanges and payments platforms under the MiCA (Markets in Crypto-Assets) regulation. This legislation aims to bring clarity to an industry that has become known for its lack of transparency and regulation.

The parent organization, the European Commission, is working toward aligning Europe’s crypto token and coin framework. The ultimate goal is to harmonize the European framework for issuing and trading different cryptocurrency tokens and coins.

Once passed, the MiCA regulation will provide a legal framework for these platforms and allow businesses to shop within the EU under particular conditions. We can expect to see:

- Stablecoins, utility coins, and e-money tokens to be added to the list of regulated products

- Platforms offering both fiat and cryptocurrencies must conform to AML (anti-money laundering) regulations for all their customers

- Regulation on exchanges, customer protection, and ICOs

- Well-defined rules for resolution boards that have to be run by a regulated depositary

- Excessive speculation to be reduced by imposing limits on crypto-derivatives trading

By harmonizing the European crypto market and bringing transparency and clarity to crypto-assets, the MiCA regulation will not only help establish legal certainty across the EU, but it will likely also encourage additional institutional investment.

Cryptocurrency regulation in Spain

The EU created MiCA regulations to protect Europe in its entirety, but cryptocurrency platforms will also have to respect each country’s legislation. In Spain, for example, the Royal Decree Law 7/2021, which focuses amongst other things on money laundering prevention, requires crypto-platforms to make their information public, keep written records of all transactions, and more.

Every exchange that wants to operate in Spain or with Spanish customers must also register in the Sepblac and Bank of Spain registries. In addition to registration, companies must appoint a representative in Sepblac. Crypto platforms that fail to do so could incur penalties of up to 10 million Euros. Moreover, to be able to provide fiat currency transfers from and to the crypto platform, you also need to either possess an EMI (Electronic Money Institution) license yourself or offer these services via a provider that holds it.

When it comes to transactions, exchanges must be able to:

- Validate the identity of the clients

- Determine the origin of the funds

- Guarantee the traceability of these funds

Also, as token operators are currently not regulated, they escape the supervision of the Spanish National Securities Market Commission (CNMV), which automatically puts them on its grey list of suspicious entities. This makes it impossible for crypto platforms to collaborate with traditional financial entities and slows their growth. In order to be white-listed (once the regulation is approved), crypto platforms will need to be more transparent about money movements and traceability.

As you can see, the European regulatory framework will have repercussions across Europe. In fact, Spain has already set new regulations for crypto and exchange platforms that want to operate both from, and in Spain, meaning a business that operates out of France has to comply with Spanish anti money laundry laws if they have Spanish clients.

As time passes, the regulations across Europe will likely become more specific, and potentially even harder to comply with as cryptocurrencies become more intertwined with traditional finance, and the crypto world needs to get ready to face them.

Complying to both sets of rules and any other that might come in the future is your best bet to avoid the 10-million euro fine for violating Spanish digital currency laws or be banned from Europe by MiCA.

Finally, besides meeting any crypto legislation, all crypto platforms that want to offer fiat pay-in and payouts must also comply with PSD2 regulations.

How can Banking-as-a-Service serve crypto platforms?

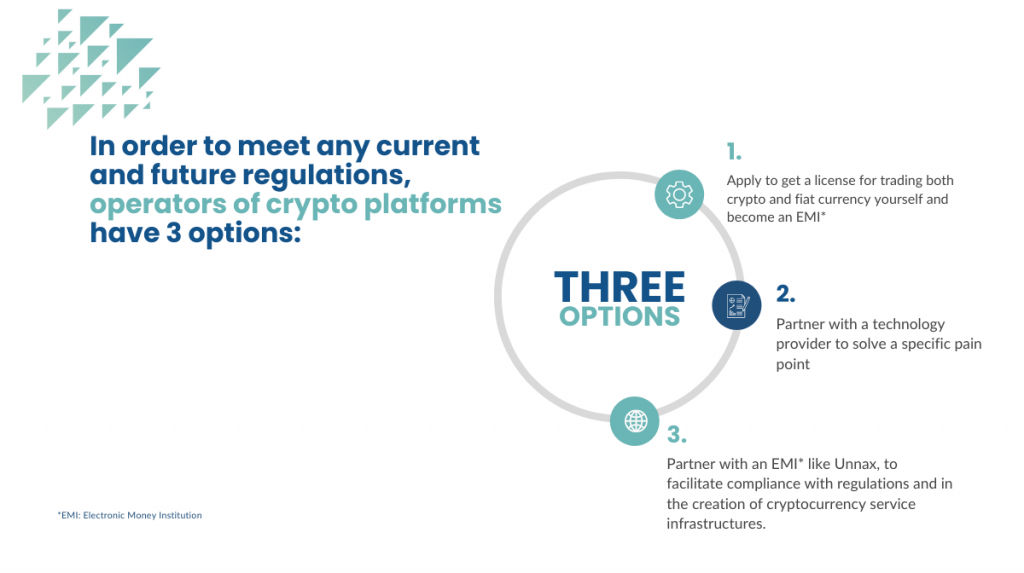

BaaS providers can help provide a regulated fiat ecosystem for crypto platforms by offering integrations, solutions, and platforms to manage financial workflow more efficiently whilst complying with PSD2 regulations. Thus, in order to meet any current and future regulations, operators of crypto platforms – or those looking to build one – have three options:

- Apply to get a license for trading both crypto and fiat currency yourself and become an EMI. This can take around two years to get an answer back from the Bank of Spain. This also requires significant technology investment to meet AML, KYC (Know your customer), and other rules.

- Partner with a technology provider to solve a specific pain point. For example, a crypto platform could choose to partner with a payments provider to help manage their transactions, or a compliance provider to onboard new clients.

- The easiest solution is to partner with an EMI like Unnax. Unnax provides the entire package, from ensuring you’re compliant with fiat regulations inside the crypto world, to building new infrastructure around cryptocurrency services, to having a wealth of technology available at your fingertips, Unnax is the easiest way to remain compliant and grow.

Partnering with an EMI and BaaS company will solve the main regulatory and technology challenges relating to crypto platform needs in the fastest possible way since your partner will enable you to meet the following requirements:

- Validate new clients under the KYC/KYB & AML parameters

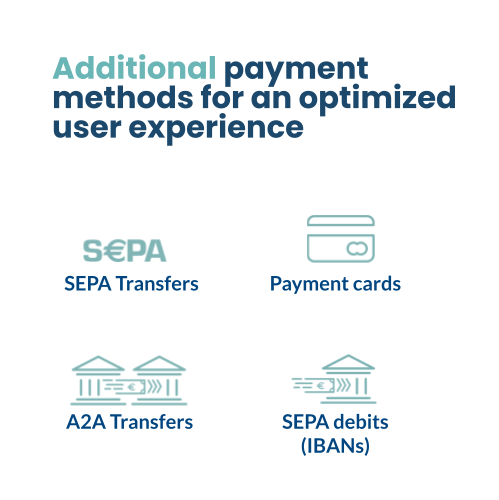

- Offer payment methods to allow your clients to fund their wallets or accounts in euros via debit/credit card or SEPA direct transfer and settle their funds with a transfer to their bank account whenever they wish

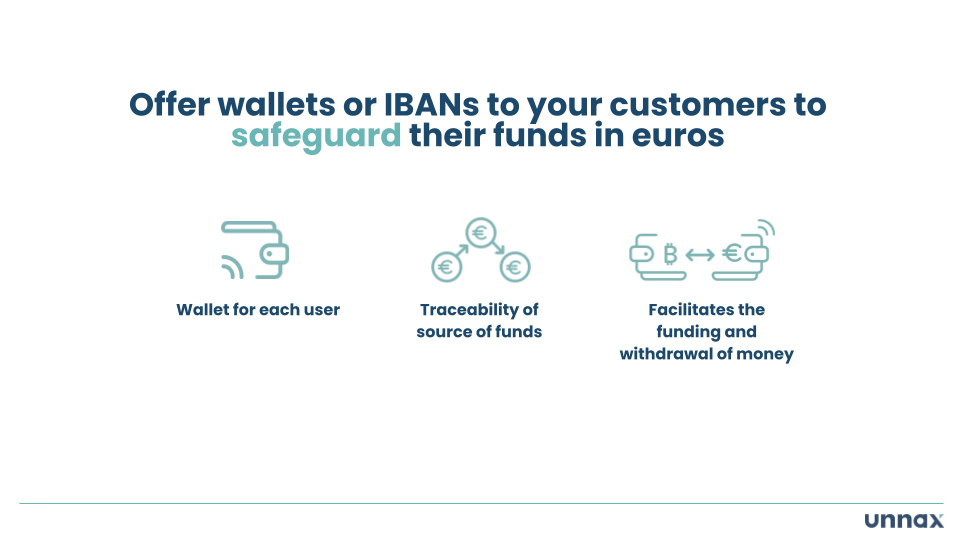

- Offer digital wallets and IBAN accounts to facilitate e-money transfers and escrow accounts to safeguard funds in euros

- Build banking services with IBAN accounts to offer services like loan, investment and payroll domiciliation. Also makes conciliation an easier process.

Below we show how these work in more detail.

Onboarding new clients

BaaS can be a huge help when it comes to onboarding new clients. By helping with the KYC/KYB and AML process, they ensure you only register new users who pass a background check. For instance, Unnax would be able to work with you in speeding up the process of account verification and approval, both in terms of KYC and KYB authority and legal acceptance.

Our program will check any blacklists and sanction lists your clients might appear on. We will immediately notify you to prevent money laundering, terrorist funding, and scams if they do.

Payments

Payments

Payments are the biggest customer experience challenges for most crypto platforms. After all, you don’t want to lose out on potential users just because you’re not offering payment solutions that allow them to add funds or cash out money easily, quickly and at a low cost. Fortunately, you can address this issue by simply teaming up with a BaaS provider.

This enables you to offer new payment methods in no time and significantly reduce transaction costs for both you and your end-users.

Digital Wallets

Working with a BaaS provider allows you to create bank accounts, IBANs and digital wallets for all your users with ease. These BaaS-based wallets greatly improve the user experience by facilitating the payment process and ensuring funds are always held by a reliable third-party. A collaboration with a BaaS provider also helps with compliance. In particular, to meet the regulations requiring you to be always able to identify the origins of funds invested in your platform and the money flows that occur within it. It also allows you to create IBANs and bank accounts for direct bank transfers.

EMI license

The EMI license is a critical aspect. It allows crypto platforms to be compliant with the traditional financial sector, and enables companies to create their own banking infrastructure. By leveraging an EMI, companies can offer crypto-fiat services within a safe, secure and regulated environment. Unnax’s fully-fledged infrastructure and EMI license enable any crypto platform to create new business models, enhance growth opportunities, offer new services in a compliant and transparent way, and participate in existing, and future EU markets without having to worry about regulation.

What are the benefits of having Unnax as a technology and regulation partner?

For an all-inclusive solution, look no further than Unnax, a Fintech company that delivers Banking-as-a-Service to cryptocurrency platforms. Working with us creates benefits for both you and our end users.

Benefits for crypto platforms working with Unnax:

- Stay ahead of possible sanctions

- Register only new users who do not belong to national and international watch lists

- Control the origin of the funds invested by each user

- Reduce their transaction and custody costs whilst improving speed

- Improve conversion and loyalty rates by implementing an onboarding, pay-in, and pay-out solution with superior user experience

- Have the necessary infrastructure (incl. the ability to create Spanish IBAN accounts) on which to build banking/financial services

Benefits for your users:

- Greater trust in your crypto platform

- Protection against any fraud attempt

- Optimal user experience for both onboarding and settlement of funds – which is currently a major pain point for crypto platform users around the world

- Improved fiat currency transaction costs and time for fiat currency

In short, with our full range of services, Unnax can help your platform grow in the right direction.

Team up with Unnax to grow and stop worrying about regulation

If you’re a cryptocurrency platform that needs guidance on regulation and technology, Banking-as-a-Service is the right solution for you. Gone are the days when you had to manage your own risk. Now, you can work with an established company that will help you grow.

With our EMI license and bank-grade security, we can ensure that your platform is fully compliant with all existing laws and regulations, allowing for increased safety for both users and the platform itself.

To learn more about how Unnax can help your crypto boat stay afloat in a regulated environment, visit this page