If you operate a business in the EU, you are likely familiar with SEPA Instant Credit Transfers, also known as SEPA real-time payments.

According to the European Payments Council (EPC), more than 2,200 payment service providers (PSPs) have joined in on the new payment scheme. Within the Euro area specifically, roughly 71% of PSPs have adopted the technology and resources necessary to enable instant payments.

Today, we are covering all of your most pressing questions about SEPA Instant Credit Transfers — starting with what they are and what regulators hope to achieve through the SCT Inst scheme.

What are SEPA Instant Credit Transfers & what are the origins of SEPA?

A SEPA Instant Credit Transfer, or SCT Inst for short, refers to an instant payment scheme in the Euro payment region (also called the Single Euro Payment Area, or SEPA). This payment scheme is also widely referred to as “immediate” or “real-time” payments.

Using SCT Inst transactions, citizens and businesses in the SEPA region can make real-time money transfers with the funds becoming available immediately upon receipt.

First launched in 2017, the SCT Inst scheme is designed to increase the harmonization of instant payments in the SEPA region, as well to establish a clear set of rules and best practices for instant payments.

As of November 2023, the European Council and European Parliament reached a political agreement regarding the instant payments proposal. According to the official press release:

The SCT Inst initiative is part of the larger initiative to complete the Capital Markets Union. Regulators aim to achieve four main goals through the establishment of SCT Inst:

- Make instate Euro payments universally available

- Make instant Euro payments affordable

- Increase trust in credit transfers

- Remove friction in the instant payment transfer process

How long do SEPA Instant Credit Transfers take?

SEPA Instant Credit Transfers happen almost instantaneously upon initiation of the transfer. According to the recent EU Council and Parliament press release on November 7th, 2023, SEPA Instant Credit Transfers allow transfers to occur within ten seconds.

In addition to the ten-second transfer speed, SEPA Instant Credit Transfers can also occur at any time of the day, including outside of normal business hours.They can be completed within ten seconds both within the same country and cross-borders between different EU member states.

💡 You may like: Cross-border instant payments: The future of international transactions

What is the SEPA Instant Credit Transfer coverage?

The SEPA region extends across all of the 27 EU member states, as well as 9 non-EU countries (Andorra, Iceland, Liechtenstein, Monaco, Norway, San Marino, Switzerland, UK, and Vatican City). Currently, SCT Inst is available in 29 of the 36 countries within the SEPA region, though the ultimate goal of regulators is to increase availability across all 36 countries.

What is the maximum amount of money that can be sent via a SEPA Instant Credit Transfer?

The maximum amount of money that can be sent via a SCT Inst is currently €100,000.

What are the advantages of SCT Inst compared to standard transfers?

SEPA Instant Credit Transfers offer many exceptional benefits that make the payment scheme a worthwhile endeavor for regulators. Along with helping to achieve the four goals discussed earlier, the European Central Bank also outlines the following key advantages of SCT Inst:

- Cost, resource, and time savings on credit transfers

- Faster sending and receiving of funds

- Immediate access to funds, reducing liquidity needs for businesses

- A more efficient economy

- Immediate reconciliation facilitation

How do Unnax SEPA Instant Credit Transfers work & what are the benefits?

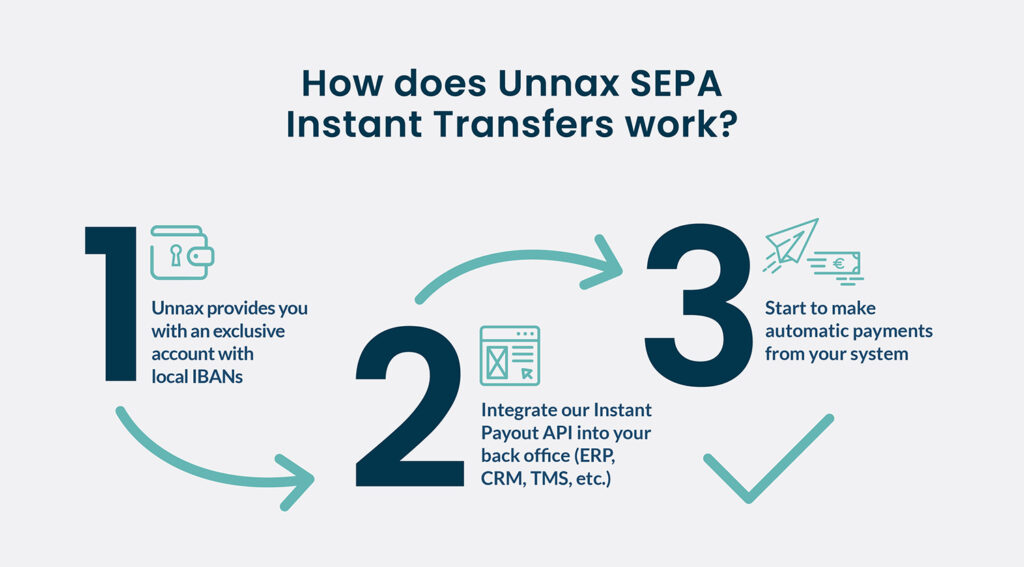

At Unnax, our SEPA Instant Credit Transfers offer everything your business needs to take advantage of real-time payments. After integrating with Unnax, our API handles all the scheduling and issuing of instant payments on your behalf through a three step process:

- Unnax provides you with an exclusive account with local IBANs

- You integrate our Instant Payout API into your back office

- Once integrated, you can begin making automatic payments without leaving your system (ERP, accounting software, etc.)

Along with streamlining your payment management process, Unnax’s SEPA Instant Credit Transfers solution also minimizes manual processes and reduces the risk of human error. As a result, you can enhance the satisfaction of customers and suppliers, all while ensuring excellent business scalability and seamless user experiences.

Additional benefits of Unnax’s SCT Inst solution include:

- Fully automated, 24/7 payment processing

- Comprehensive management of the payment process

- Real-time, programmatic access to Unnax’s API for direct and seamless interactions

- No need for Strong Customer Authentication (SCA) as transactions are performed and signed via the Unnax API

- As a licensed Electronic Money Institution, Unnax has complete control over all processes when an account we provide is used to process a payment. PISP’s that aren’t an EMI do not offer this. We also provide a direct connection with the clearing house

- Top-notch fraud prevention through the issuance of a money receipt certificate

Get started with Unnax today to take full advantage of SEPA Instant Credit Transfers. Book a free 30 minute strategy call here.