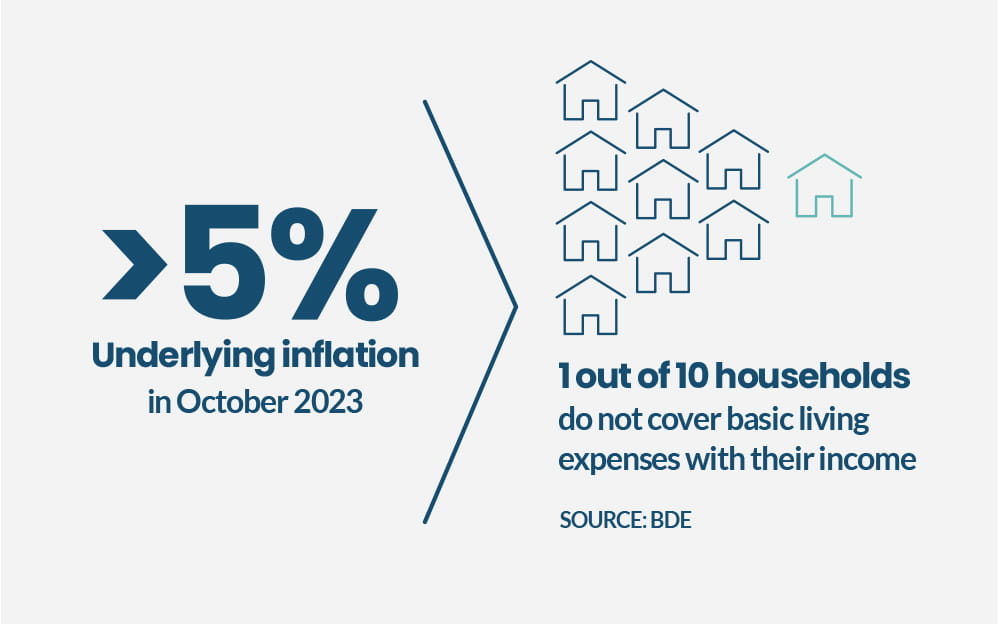

All lenders eventually deal with default — even those with highly powerful and reliable scoring systems. This is particularly true in the currently challenging economic environment, with signs indicating an increase in defaults is incoming. In Spain, for instance, a Bank of Spain report shows that almost 1 in 10 households are not able to cover their essential expenses with their current income, and core inflation hit over 5% in October 2023.

For growing organizations especially, the ability to differentiate between instances of loan default and loan fraud is vital for overall business resilience and efficiency.

A lack of this ability often stems from technological deficits in scoring and onboarding processes, requiring the lender to update its technology to distinguish loan fraud cases from default scenarios more accurately.

Understanding fraud vs. default in lending portfolios

When dealing with missed payments from borrowers, lenders must consider whether the borrower is falling into arrears after failing to meet repayment responsibilities or if they intentionally took out the loan with no plan to repay it.

Loan default refers to the first scenario in which borrowers cannot currently make their loan repayments, leading to missed payments and arrears. If a borrower fails to make their missed payments within a set timeframe, consequences for default can vary from late fees to legal action.

Meanwhile, loan fraud refers to borrowers acting with deliberate deception to obtain funds with no intention of repaying the lender. Loan fraud typically includes falsified documents, stolen identities, or other fraudulent means to secure a loan.

A recent LexisNexis study reveals that SMB lending fraud is particularly prevalent, increasing at an average of 14.5% from 2021 to 2022. Meanwhile, Motley Fool research reports that there were more than 1.1 million reports of identity theft in 2022 alone, with more than 550,000 cases in the first half of 2023.

Three types of fraud we commonly see in lending include:

- First-Party Loan Fraud (Personal Loan Fraud): Personal loan fraud involves loan applications submitting false information to obtain better loans and lending conditions.

- Second-Party Loan Fraud (Straw Buyer Fraud): Straw buyer fraud involves loan applicants using the personal information of a willing second person to obtain a loan.

- Third-Party Loan Fraud (Identity Theft): Identity theft refers to loan applicants stealing an unwilling and often unknowing person’s identifying information and passing this information off as their own to obtain a loan.

👉 To find out more about these types of fraud (and how Unnax can help you combat them) check out this article by clicking the link here.

The distinction between loan default and fraud is vital for lenders, as it enables organizations to make more effective and informed decisions regarding resource management.

With robust processes in place to not only differentiate but prevent instances instances of default and fraud, collection departments can spend less time hunting down payments that fraudsters never intend to repay, and lenders can improve their fraud identification processes.

Leveraging technology to reduce risks of fraud & defaults

The challenge of differentiating loan default from fraud often comes down to lenders having the right mix of technological resources and support. With an optimized technology strategy in place, lenders can reduce the risks of fraud, arrears, and defaults with greater accuracy and efficiency.

Safeguarding the onboarding phase of the lending process is especially crucial. Implementing tech-based solutions helps lenders create more robust customer identification processes, analyze customer profiles in greater depth, and increase validations across payment methods.

To help lenders achieve this, Unnax offers the following solutions:

- Bank account aggregation & recurring aggregation: Bank account aggregation is the process of collecting banking data from all of a customer’s accounts and organizing it in one central location. Unnax’s Account Aggregation solution for single and recurring readings help lenders obtain larger quantities of high-quality information, enabling them to gain a more comprehensive and accurate overview of a borrower’s financial situation.

Additionally, Account Aggregation provides lenders with the proof of life needed to verify that a borrower is a real user exhibiting real-life behaviors across their financial accounts. With this solution, lenders gain real-time access to aggregated financial data, connections to personal and business bank accounts, and powerful filtering capabilities to tailor data output based on each lender’s specific needs.

- Account ownership validation: Account ownership validation involves verifying that a customer is the owner of a bank account by cross-referencing the information provided by the customer with their IBAN and identification number. Unnax’s Account Ownership Validation solution facilitates compliance with customer identification obligations (such as KYC requirements), validates customer information by cross-referencing it with official client data from the customer’s bank, and helps to avoid and reduce fraud attempts.

Additionally, companies can perform ownership validations either individually or in batches with just the client’s IBAN number and identification number. Through this solution, lenders can verify accounts instantly at all hours of the day without requiring customer interactions.

- Certificates: Unnax offers certificates for account aggregation and receipt of funds to help lenders present necessary evidence if a fraud case occurs. These certificates are crucial in the litigation process by providing proof that a transfer has been sent and received. Additionally, they also aid in preventing identity fraud cases where a customer claims they didn’t request a loan, as well as in proving that a borrower has defaulted and owes the lender payment.

Unnax’ solutions offer robust capabilities that allow lenders to gain on-demand access to their borrowers’ financial data, enabling faster decision-making processes safeguarded against fraud.

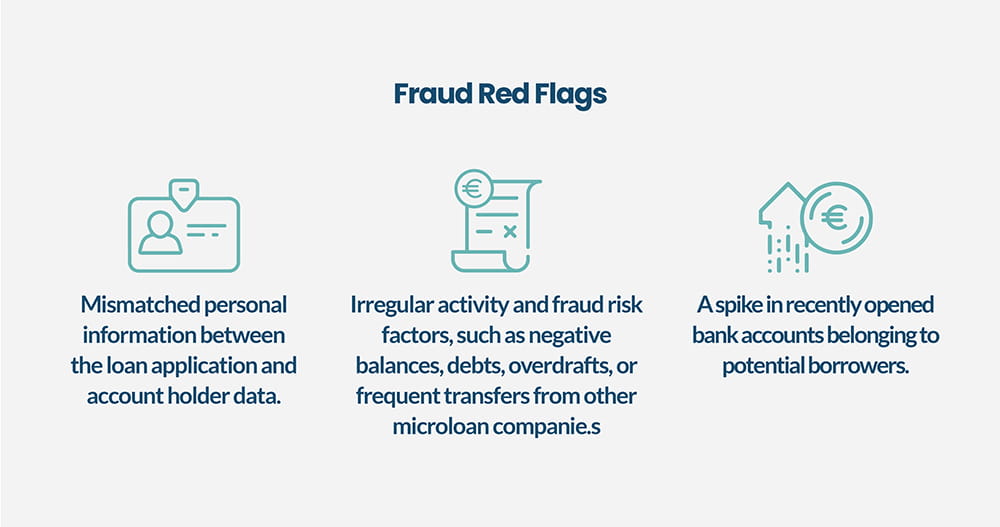

Together, account aggregation, account ownership validation and certificates aid lenders in detecting numerous red flags of fraud, including:

- Mismatched personal information between the loan application and account holder data.

- Irregular activity and fraud risk factors, such as negative balances, debts, overdrafts, or frequent transfers from other microloan companies.

- A spike in recently opened bank accounts belonging to potential borrowers.

As a result, lenders have greater clarity surrounding loan applicants and their ability and willingness to repay borrowed funds. Because of this clarity, lenders are better equipped to prevent fraud and help borrowers reduce their likelihood of default in the long-term.

Ready to improve your lending processes to reduce the risk of lending fraud and defaults? Get started with Unnax today to leverage our Account Aggregation, Payment Solutions and Account Ownership Validation solutions.