Read our the 2024 payment trends report here

Digital payments have taken center stage in 2022.

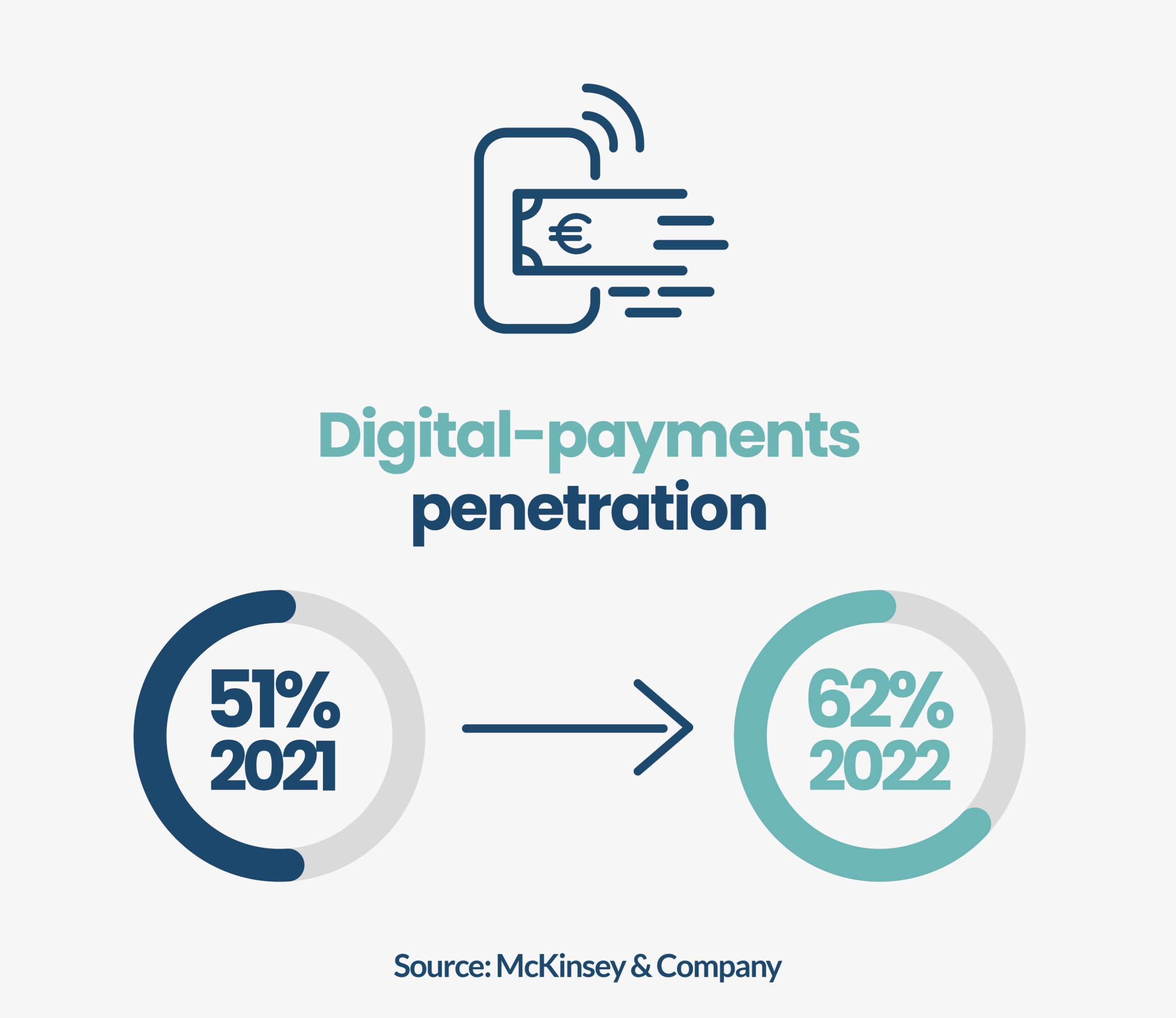

In a recent McKinsey & Company report, it is revealed that the percentage of consumers using digital payments made an impressive jump from 51% in 2021 to 62% in 2022. Of these, in-app purchases and peer-to-peer (P2P) payments have experienced the biggest growth.

As regulators around the world continue to focus more heavily on digital finance, digital payments are becoming more tightly interwoven into the global financial services industry.

In this article, we take a look at five of the top trends in the digital payments market for 2023 and beyond. From popular payment methods like Buy Now, Pay Later (BNPL) taking the payment industry by storm to the rise of cross-border instant payments, these trends are bringing innovative change to the digital payments landscape.

Keep reading to learn all about the digital payment trends you need to know for 2023. Plus, we discuss how Unnax can help businesses in Southern Europe embrace these trends.

Read straight through, or jump to the section you want to read:

- Cross-border instant payments

- Contactless payments: Virtual cards & wallets

- Buy Now, Pay Later (BNPL) for B2B

- Variable recurring payments

- Peer-to-peer payments (P2P)

Top 5 digital payment trends 2023

1. Cross-border instant payments

As the payments industry becomes more and more global, international business opportunities are rising as well. This has led to a need for faster and more secure international payment options.

Cross-border instant payments offer businesses and consumers alike the opportunity to experience real-time payments by connecting to financial institutions and systems in two or more countries instantly.

According to a 2020 Juniper Research report, instant payments where funds are settled in less than 10 seconds are expected to account for 9.3% of all B2B transaction volume in 2022. The report also notes that blockchain technology is likely to play an increasingly prominent role in the cross-border market thanks to its ability to offer greater efficiency and transparency.

However, much development and innovation are still needed in the cross-border instant payments market.

A November 2022 report from the International Monetary Fund (IMF) states that cross-border payment connections between two countries must be tailor-made, which takes “time and significant efforts” to accomplish. The IMF highlights that multilateral cross-border payment platforms are a promising path that can potentially deliver a “transformational impact” in the cross-border instant payment industry. The EU has also acknowledged this trend, rolling out a new proposal in October 2022 to amend existing regulations regarding cross-border instant payments.

👉 Read more: Cross-border instant payments: The future of international transactions

2. Contactless payments: Virtual cards & wallets

In March 2022, Kantar Public published a Study on New Digital Payment Methods.

This study’s main objective was to provide the European Central Bank with a more thorough understanding of preferred payment methods and habits of citizens in the Euro area.

A key finding is an increased preference for contactless payments, with the study reporting a spike in the popularity of contactless versions of cards since the onset of the Covid-19 pandemic.

Mobile payment options, such as digital wallets and apps, were also included among the preferred payment methods discovered. Respondents cited speed, convenience, and ease of use as some of the top reasons why they preferred mobile payments.

The study further states that:

“ — one common theme emerged among both the general public and the tech-savvy: participants would appreciate if the digital wallet was a “one-stop-shop” solution. They would not be interested in an additional payment option, but rather in a new method that would either replace most or all of the current methods or combine them into one system.”

👉 Read more: Digital Wallets: What are they & how can they benefit your business?

3. Buy Now, Pay Later (BNPL) for B2B

Buy Now, Pay Later — or BNPL for short — is a type of installment loan in which a financial service provider enables customers to pay for a product or service in several small, interest-free payments.

While the customer is given greater financial flexibility, the business offering the product or service does not miss out on revenue. A BNPL provider will often pay out the business for the full amount of the purchase, handling the installment loan payments directly with the customer.

As BNPLs become more widely regulated, this also opens up new business opportunities beyond the traditional B2C use case. For instance, for B2B companies by offering more secure and trustworthy services. One of the key advantages of BNPLs for B2B companies is the ability to offer or make big-ticket purchases without having to pay the full amount upfront, enabling BNPLs to serve as investment-like tools. The surge of BNPL in the B2B sector, on top of its popularity in the B2C sector, makes it one of the fastest growing digital payment trends. In fact, the global BNPL market is expected to grow at an annual rate of 26% from 2022 to 2030, reaching a value of $39.41 billion (USD) by 2030.

4. Variable recurring payments

With 71% of small-to-mid-size enterprises expected to adopt Open Banking services by 2022, it has never been more important to begin leveraging them.

The rise of Open Banking payments has led to many new digital payment methods. One such method is variable recurring payments, or VRP for short, and it’s bound to become a huge payment trend in 2023.

VRPs utilize the permissions granted via Open Banking agreements to allow authorized payment providers to make payments on the behalf of customers within the boundaries of the agreement. This is considered a better alternative to other recurring payment options, such as direct debits.

For example, a tech company could offer a B2B company a scalable solution that can vary in price according to use. When creating a payment agreement for this solution, a VRP could be used to automatically carry out these payments within the limits of the arrangement.

One key advantage of VRPs is that they enable near-instant payments — something that is in high demand with customers and businesses alike.

Currently, this is only available in the UK, but we’re looking forward to its future expansion across the rest of Europe.

5. Peer-to-peer payments (P2P)

Peer-to-peer (P2P) payments have existed for a while now but are quickly becoming more widespread and popular with the growth of the digital payments market.

Globally, the P2P market is experiencing accelerated growth thanks to increasing smartphone penetration in the payments landscape and evolving digitalization of the industry. According to a September 2022 market report, the global P2P market is forecast to reach a market size of $9,135B (USD) by 2030.

As mentioned, smartphone usage is a driving force behind P2P payment growth. Insider Intelligence reports that the UK is expected to reach 18.1M mobile P2P payment users in 2022, up from 17.1M in 2021.

One hurdle P2P sites may need to overcome is that all P2P sites operating in the EU need to be licensed CSPs as of November 2022. However, this is a good thing; as P2P payments become more regulated, this can help reduce payment friction and boost payment speed even further.

Final thoughts: Utilize Unnax’s platform for digital payments

Here at Unnax, our Banking-as-a-Service platform provides your business with the personalized payment services needed to succeed in 2023 and beyond. We help our clients provide different payment methods to process payments faster and at a lower cost.

To learn more about the Unnax API and banking as a service platform, contact our team today!