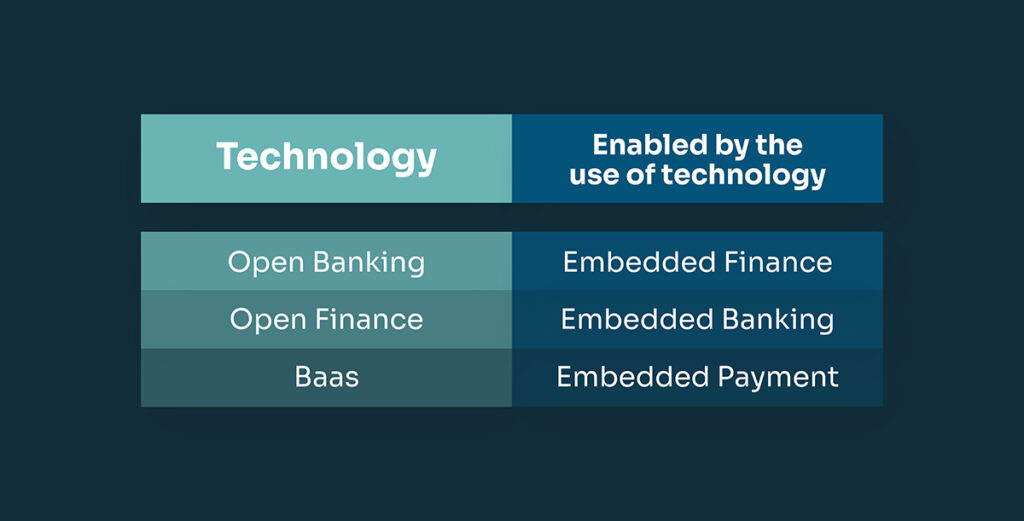

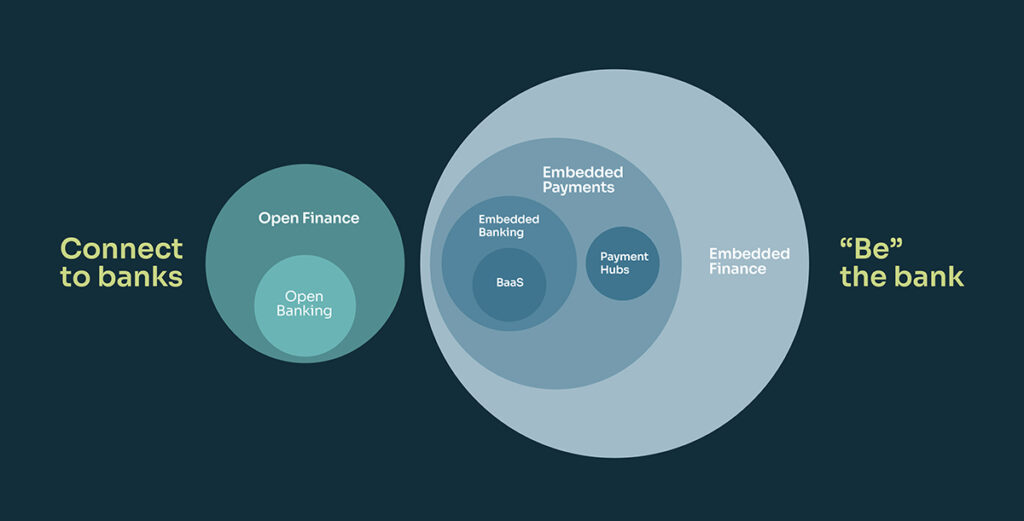

If you’ve dipped a toe into the world of financial services as a non-traditional financial company or software company, you’ve probably heard of Open Banking, Open Finance, Embedded Finance, Embedded banking or Banking-as-a-Service (BaaS).

Given that 92% of firms surveyed in Europe in 2021 had plans to offer embedded banking features within the next five years, the chances are pretty high that your competitors have looked towards these technologies to help them deliver convenient and secure products to their users in 2024 and beyond.

Here’s an overview of what those terms actually mean — along with the difference between each one — so that you can navigate today’s banking tech landscape with confidence.

Open Banking

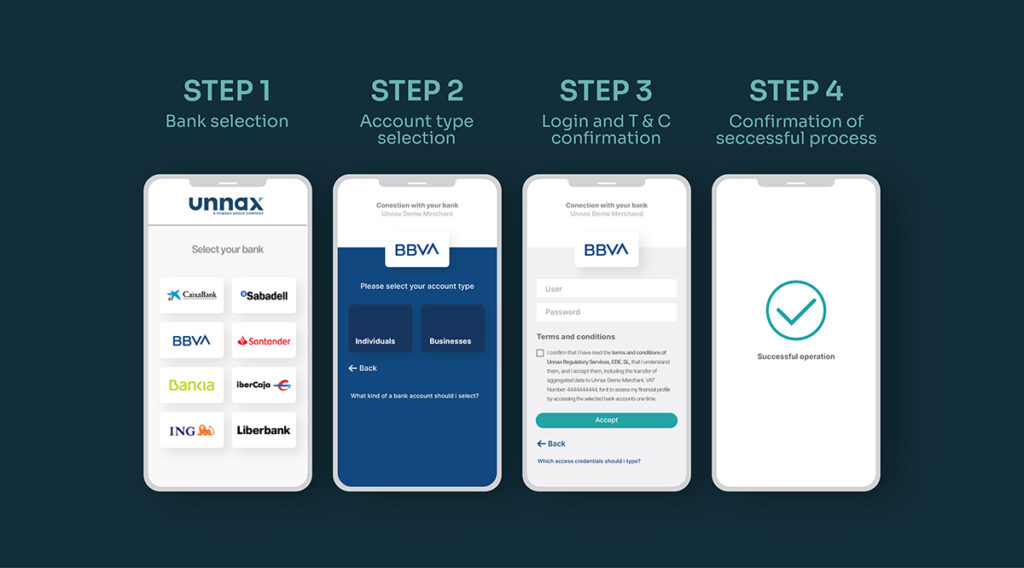

Definition: Open Banking is a regulatory initiative spearheaded by the UK’s Open Banking Standard and the European PSD2 regulation. Through Open Banking technology, consumers and businesses can consent to sharing their financial information with third-party providers, allowing for more seamless financial services.

While government-backed Open Banking may have taken roots in Europe, other countries have adopted a more market-driven strategy. One Deloitte report showcases that countries like the U.S., Japan, India, Singapore, and South Korea all follow a market-driven approach to Open Banking, despite the lack of government-backed regulatory support.

The guiding principles of Open Banking are as follows:

- Strong customer authentication (SCA)

SCA is a core tenet of PSD2 that follows strict regulatory requirements and enhances protection against fraud in digital transactions.

- Customer consent

In both the UK and the EU, Open Banking regulations require explicit consumer or business consent before any financial information can be shared. With consumer consent, financial institutions can share information with different financial services, allowing businesses to engage with solutions like account-to-account (A2A) payments and account aggregation with greater success.

- APIs & seamless payments

Open Banking transforms payment processes with APIs, enabling seamless and secure transactions. Through Account-to-Account (A2A) payments, funds move directly from a buyer’s bank account to a seller’s, allowing quick transactions without relying on traditional payment systems. This direct approach not only speeds up the payment process but also enhances security and reduces costs for businesses.

👉 Learn more: Leveraging Technological Solutions to Combat Fraud & Default in Lending

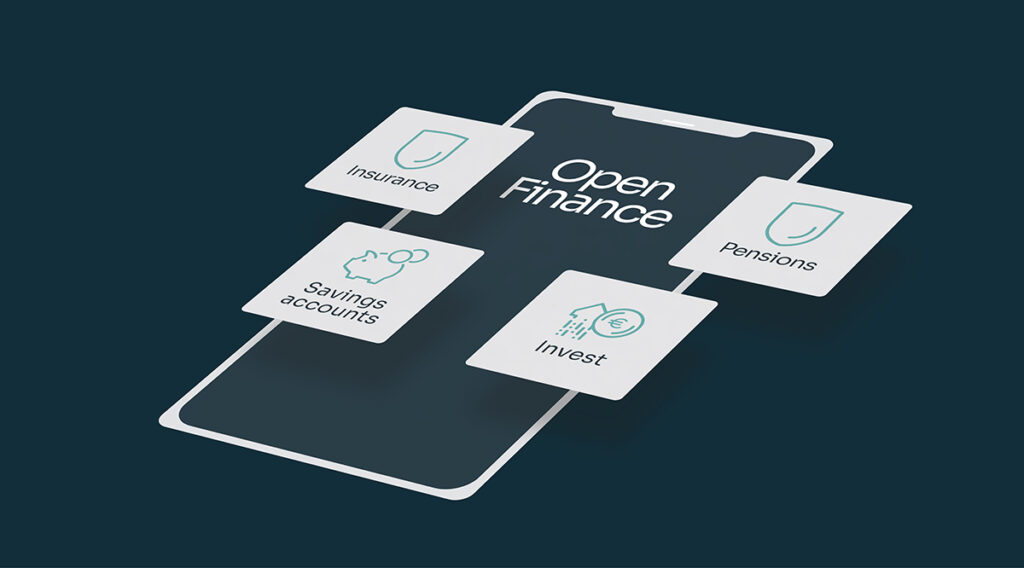

Open Finance

Definition: Open Finance is an off-shoot of the Open Banking regulatory initiative that seeks to extend data sharing into a wider selection of financial products. If implemented, Open Finance technologies can enable data sharing and third-party access to savings accounts, investments, insurance, and pensions.

In a March 2023 keynote speech on the future of Open Banking and Open Finance, European Commissioner Mairead McGuinness stated that Open Finance enables more personalized financial product offerings. Additionally, she identifies three key problems Open Finance helps address:

- Increased customer trust

Rather than simply allowing customers to consent to data sharing, Open Finance focuses on ensuring the customer knows exactly what data they are sharing, who it is being shared with, and why it is being shared.

- Greater access to data

Open Finance emphasizes API integrations, providing more channels for customers, banks, and third-party providers to communicate and share information. Specifically, Open Finance can provide access to savings accounts, loans, investments, cryptocurrency, group savings, and pension plans.

- Technical standardization

As regulators continue to advance Open Finance initiatives, like PSD3, these initiatives are likely to result in standardized technical interfaces. Standardizing the technical infrastructure needed for Open Finance allows for more seamless data sharing and collaboration.

BaaS (Banking-as-a-Service)

Definition: Acting as an infrastructure layer, Banking-as-a-Service (BaaS) provides regulatory and technological support, enabling seamless integration of banking products and services, such as bank accounts, cards, and payment solutions, into non-banking platforms. Through API integration and technology-driven partnerships, BaaS enables companies to offer banking services without the need for a banking license.

Characterized by McKinsey as a “€100 billion opportunity in Europe,” BaaS is a key enabler to trends like embedded finance and embedded banking. Per McKinsey, BaaS offers four strategic advantages:

- Boosted revenue and profitability

BaaS enables non-financial and non-technology companies to compete in financial markets, leading to higher revenue and customer acquisition.

- Regulatory Simplification

BaaS simplifies regulatory compliance by leveraging the infrastructure of licensed technology partners. This partnership streamlines adherence to regulations, freeing companies to concentrate on innovation instead of navigating complex compliance requirements.

- Increased and enhanced customer interactions

BaaS allows businesses to establish more customer touchpoints, including in their day-to-day digital interactions (i.e. smartphone apps).

- Digital transformation

The introduction and growing popularity of BaaS encourages traditional financial institutions to accelerate their digital transformation initiatives.

Embedded finance

Definition: Embedded Finance seamlessly integrates financial services into digital environments using APIs, providing diverse and relevant solutions at the point of need within customer journeys. It emphasizes a cohesive and automated experience, offering customers more choices while ensuring control over financial outcomes.

This BaaS-powered approach connects businesses with embedded payments, lending, and banking services that boost efficiency while simultaneously addressing compliance issues, integration, and development costs.

Embedded finance emphasizes automation for efficient and smooth financial services. According to McKinsey, what makes the embedded finance tools of today so powerful is “the integration of financial products into digital interfaces that users interact with daily,” such as loyalty apps, digital wallets, accounting software, or e-commerce platforms.

The benefits of embedded finance include:

- Enhanced customer experiences

The ability to embed financial services into non-financial products enhances the customer experience by providing a one-stop financial solution.

- Increased revenue

Embedded finance tools create new revenue flows by increasing coverage and enabling the creation of new products.

- Low implementation costs

For businesses, embedded finance incurs significantly lower implementation costs than building standalone or in-house financial products via an official partnership with an embedded finance partner.

Embedded banking

Definition: Embedded banking is a subset of embedded finance that encompasses the integration of banking capabilities like accounts, payment services, and card issuing into non-banking digital environments. With this technological approach, any company can roll out banking capabilities with ease, including non-financial firms.

Embedded banking provides three primary benefits to businesses:

- Seamless integrations

White label embedded banking solutions allow non-financial companies to offer customized and fully integrated banking capabilities. These services can be rolled out quickly with the company’s branding without requiring significant internal resources or development.

- Regulatory shield

Licensed providers can ensure you have access to simplified financial and banking integrations without having to apply for a financial institution license yourself. Count on a licensed embedded banking provider, like Unnax, ensures their technologies come with the proper regulatory tools and support.

- Heightened scalability

No matter the scale of your operations, embedded banking can provide you with the technical and regulatory support needed. Embedded banking solutions can handle large transaction volumes and fluctuating demand, leveraging modern technologies to adapt to different business models.

👉 Learn how: Unibo Leveraged Unnax IBAN Accounts to Achieve 15X Growth in Just One Year

Which banking technology solutions can you build with Unnax?

Unnax helps you achieve frictionless and fully automated banking and payment experiences.

As a Powens Group Company, Unnax is the only platform that brings together Open Finance and Embedded Banking to empower financial institutions, fintechs, and software vendors to create innovative products and streamline their financial operations.

Unnax strives to reshape how companies engage with financial services, simplifying processes through compliance-first technological solutions. Our Open Finance and Embedded Banking API ecosystem allows our clients to seamlessly issue bank accounts, process payments, and get access to financial data directly from their products and internal tools.

As a regulated technology company, Unnax holds licenses as an Electronic Money Institution (EMI) for EU-wide operation, a Payment Initiation Services Provider (PISP), and an Account Information Services Provider (AISP). Unnax provides all customers with a built-in regulatory shield, allowing them to easily embed financial services without the hassle of licensing.

Based in the EU with a special focus on the SEPA region, Unnax takes full advantage of Open Banking and Open Finance regulations to help your business aggregate financial data and gain meaningful insights to inform your product development and personalization processes.

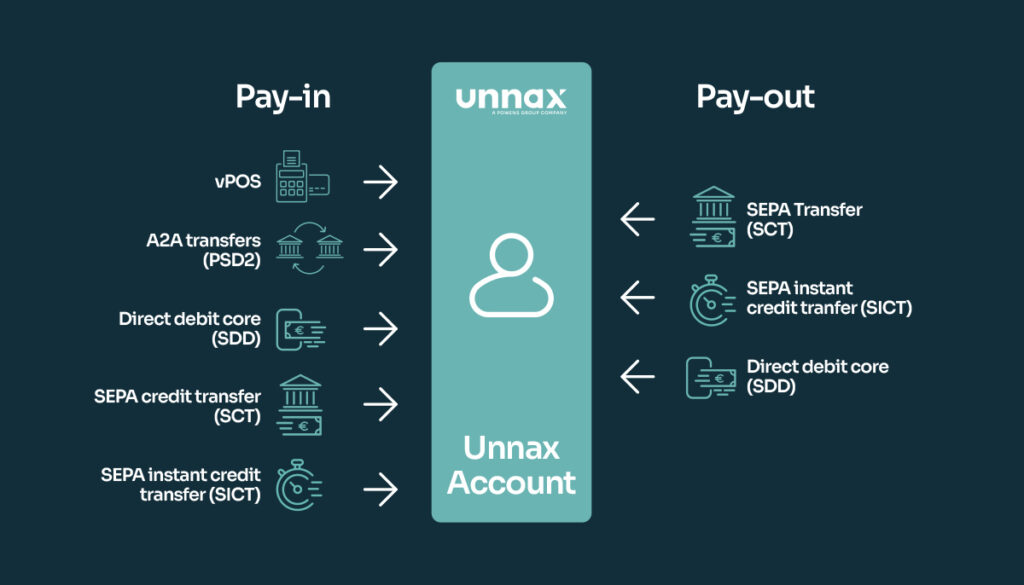

For embedded banking, Unnax offers solutions for local IBANs and SEPA payments.

Speak with Unnax today to make 2024 the year you innovate with financial services.